essaytogetherguam.online Market

Market

Commission Free Ira

Make sure you read the fine print, there is no such thing as a no-fee IRA or no fee retirement account. Transaction Fees. Transaction fees include buying. By commission? How are commissions determined? Do When researching brokers, you can visit FINRA's. BrokerCheck or call FINRA's toll-free BrokerCheck. No IRA account minimums or fees · First-class investment selection · Wide range of IRA account types · High-quality investment research and education · Excellent. Commission-free trades. $01 for online US stock, ETF, and option trades. Zero IRA closeout fee, $0, $0, $0. Late settlement fee, $0, $25, $0. Bank wire, $0. Before transferring your retirement assets to a Truist Investment Services, Inc., IRA rollover, be sure to consider investment options and services, fees. Schedule of Fees for Individual Retirement Accounts. (Traditional/SEP, Roth IRA fee you were charged by the mutual fund company. This fee applies as. Invest money with tax-free potential growth ; Fees. No setup, administrative, closure or transaction fees · Commission-free mutual fund trading. Fee schedule →. Roth IRAs can be a powerful tool for investing for retirement, but they aren't free. It pays to shop around and look for providers that charge reasonable fees—. A Roth IRA is an individual retirement account (IRA) you fund with after-tax dollars. Your investments have the potential to grow tax-free and may be withdrawn. Make sure you read the fine print, there is no such thing as a no-fee IRA or no fee retirement account. Transaction Fees. Transaction fees include buying. By commission? How are commissions determined? Do When researching brokers, you can visit FINRA's. BrokerCheck or call FINRA's toll-free BrokerCheck. No IRA account minimums or fees · First-class investment selection · Wide range of IRA account types · High-quality investment research and education · Excellent. Commission-free trades. $01 for online US stock, ETF, and option trades. Zero IRA closeout fee, $0, $0, $0. Late settlement fee, $0, $25, $0. Bank wire, $0. Before transferring your retirement assets to a Truist Investment Services, Inc., IRA rollover, be sure to consider investment options and services, fees. Schedule of Fees for Individual Retirement Accounts. (Traditional/SEP, Roth IRA fee you were charged by the mutual fund company. This fee applies as. Invest money with tax-free potential growth ; Fees. No setup, administrative, closure or transaction fees · Commission-free mutual fund trading. Fee schedule →. Roth IRAs can be a powerful tool for investing for retirement, but they aren't free. It pays to shop around and look for providers that charge reasonable fees—. A Roth IRA is an individual retirement account (IRA) you fund with after-tax dollars. Your investments have the potential to grow tax-free and may be withdrawn.

You must buy and sell Vanguard ETF Shares through Vanguard Brokerage Services (we offer them commission-free online) or through another broker (who may charge. CHARGES ABOVE FREE CASH AVAILABLE NOT APPLICABLE TO RETIREMENT ACCOUNTS Commission-free online trades apply to trading in U.S.-listed stocks, exchange. The Commodity Futures Trading Commission advises the public not to take cash from their retirement retirement account into a gold IRA. Fees for. 4. Be wary of "Free" or "No Fee" claims. Competition among financial firms for IRA business is strong, and advertising about rollovers and IRA-. Firstrade's Roth IRA took the second spot on our list for its zero-fee model. This account doesn't charge any fees for account set-up, maintenance or inactivity. A brokerage account is generally less restrictive than an IRA or retirement account; there is no contribution limit and you can withdraw your money at any time. For details, visit essaytogetherguam.online 3 If, on Dec. 31, , Edward Jones served as the broker-dealer of record for your traditional/Roth IRA. A Roth IRA is a tax-advantaged personal savings plan where contributions are not deductible but qualified distributions may be tax free. A Payroll Deduction IRA. $0 Commissions · Commission-free trading on eligible U.S. stocks and ETFs · Wide selection of commission-free ETFs from market leaders such as Vanguard, GlobalX. Individual retirement accounts (IRA) allow you to invest for retirement. Any earnings have tax-deferred or tax-free growth potential, so you will keep more of. You must buy and sell Vanguard ETF Shares through Vanguard Brokerage Services (we offer them commission-free online) or through another broker (which may charge. They charge no fee to have an IRA with them. E-Trade: E-Trade offers a wide range of investment options, including commission-free ETFs, as. But brokerage accounts are taxable, unlike IRAs which are either tax-deferred or tax-free and have rules around contribution and withdrawals. What Is an IRA? An. An E*TRADE Roth IRA lets you invest your way. Our Roth IRA lets you withdraw contributions tax-free at any time. Open a Roth IRA with us today. At Fidelity, commission-free trades come with even more value. Questions. IRA closeout fee, $0, Per Request. Cash management services. Electronic. Enjoy $0 commissions on online US-listed stock, ETF, mutual fund, and options trades with no account minimums IBKR Lite provides commission-free trades in US exchange-listed stocks and ETFs. IBKR Lite is available to US residents with the following account types. Open an account today and get unlimited commission-free online stock, ETF, options, mutual funds, and fixed income trades. Other fees may apply. Free and $0 means there is no commission charged for these trades. $0 option trades are subject to a $ per-contract fee. Sales are. $, Per transferFootnote 3. Retirement Account Fees. IRA Termination Fee, $, Per terminationFootnote 4. Trading Fees. Foreign Financial Transaction Fee.

How To Make Money Off Of Bonds

2. Earning capital gains: Many bonds are not held until maturity, as an investor you may choose to sell your bond before it reaches its maturity date. Bonds are supposed to represent the ballast in your portfolio, offsetting riskier investments such as stocks. These assets don't generate returns as high as. Bond funds make money by holding bonds and paying the interest in distributions to the fund owners. Sometimes the fund will hold a bond to. How do bonds work? A bond has a maturity date and a “coupon": you might buy a year bond with a 5% coupon for $ That means that you're giving the. If Carlos has money in a savings account or buys a U.S. savings bond, he'll earn 3 to 5% on his savings. Most businesses that raise money from the public must. Bonds can provide a stable source of income and can protect the money you invest. They are considered less risky than growth assets like shares and property. In return for buying the bonds, the investor – or bondholder– receives periodic interest payments known as coupons. The coupon payments, which may be made. In exchange for lending money, investors are paid interest on bonds, similarly to how loan providers or credit card issuers charge consumers interest when they. By buying a bond, you're giving the issuer a loan, and they agree to pay you back the face value of the loan on a specific date, and to pay you periodic. 2. Earning capital gains: Many bonds are not held until maturity, as an investor you may choose to sell your bond before it reaches its maturity date. Bonds are supposed to represent the ballast in your portfolio, offsetting riskier investments such as stocks. These assets don't generate returns as high as. Bond funds make money by holding bonds and paying the interest in distributions to the fund owners. Sometimes the fund will hold a bond to. How do bonds work? A bond has a maturity date and a “coupon": you might buy a year bond with a 5% coupon for $ That means that you're giving the. If Carlos has money in a savings account or buys a U.S. savings bond, he'll earn 3 to 5% on his savings. Most businesses that raise money from the public must. Bonds can provide a stable source of income and can protect the money you invest. They are considered less risky than growth assets like shares and property. In return for buying the bonds, the investor – or bondholder– receives periodic interest payments known as coupons. The coupon payments, which may be made. In exchange for lending money, investors are paid interest on bonds, similarly to how loan providers or credit card issuers charge consumers interest when they. By buying a bond, you're giving the issuer a loan, and they agree to pay you back the face value of the loan on a specific date, and to pay you periodic.

Bonds are supposed to represent the ballast in your portfolio, offsetting riskier investments such as stocks. These assets don't generate returns as high as. Typically considered a lower risk investment compared to stocks, bonds can be a way to invest and earn a predictable return through interest payments. Supplement your income. Bond investors typically receive payments, known as a coupon, on a regular schedule. · Put your cash to work. Return from bonds may help. Bonds are loans you make to a government, government agency, or corporation, which they use to finance projects and other needs. The bond issuer agrees to. Bonds yield income, are considered less risky than stocks and can help diversify portfolios. Learn about the different types of bonds and how they can help. Banks generally make money by borrowing money from depositors and compensating them with a certain interest rate. The banks will lend the money out to. In turn, the government agrees to pay that much money back later - plus additional money (interest). U. S. savings bonds are. Simple. Buy once. Earn interest. bond from the interest payments made on the bond, either A dealer, who will generally buy and sell a municipal securities investor's bonds, may do so. Yield of a bond fund measures the income received from the underlying bonds held by the fund. The day annualized yield is a standard formula for all bond. If interest rates go down, you may be able to sell your bond for more than you paid for it. Any profits gained from reselling bonds on the secondary market. Another way to buy savings bonds is to have your employer send money from each paycheck directly to your TreasuryDirect account. You decide how much to set. What are bonds? A bond is a debt security, like an IOU. Borrowers issue bonds to raise money from investors willing to lend them money for a certain amount. Bonds can provide a stable source of income and can protect the money you invest. They are considered less risky than growth assets like shares and property. Investing in bonds can help create a more balanced portfolio by adding diversification. Discover more about how bonds work and the benefits of the different. If your savings bond from a Series other than EE, I, or HH has finished its interest-earning life, you could cash it and use the money for something else – a. What is a yield? It's the total annual income you earn from bond coupon payments. It's stated as a percentage of the price of the bond. For example, if you have. Another common to make money off a bond is by selling it. Bonds can be A bonds yield is what you get when you divide the bonds coupon by the bonds changes in. The value of government bonds fluctuates based on supply and demand in the market – a government will increase the supply of bonds to raise money, which will be. Access to institutional pricing: Bond funds generally receive better pricing on individual bonds than individual investors do. All else being equal, a lower.

Non Revolving Line Of Credit Vs Term Loan

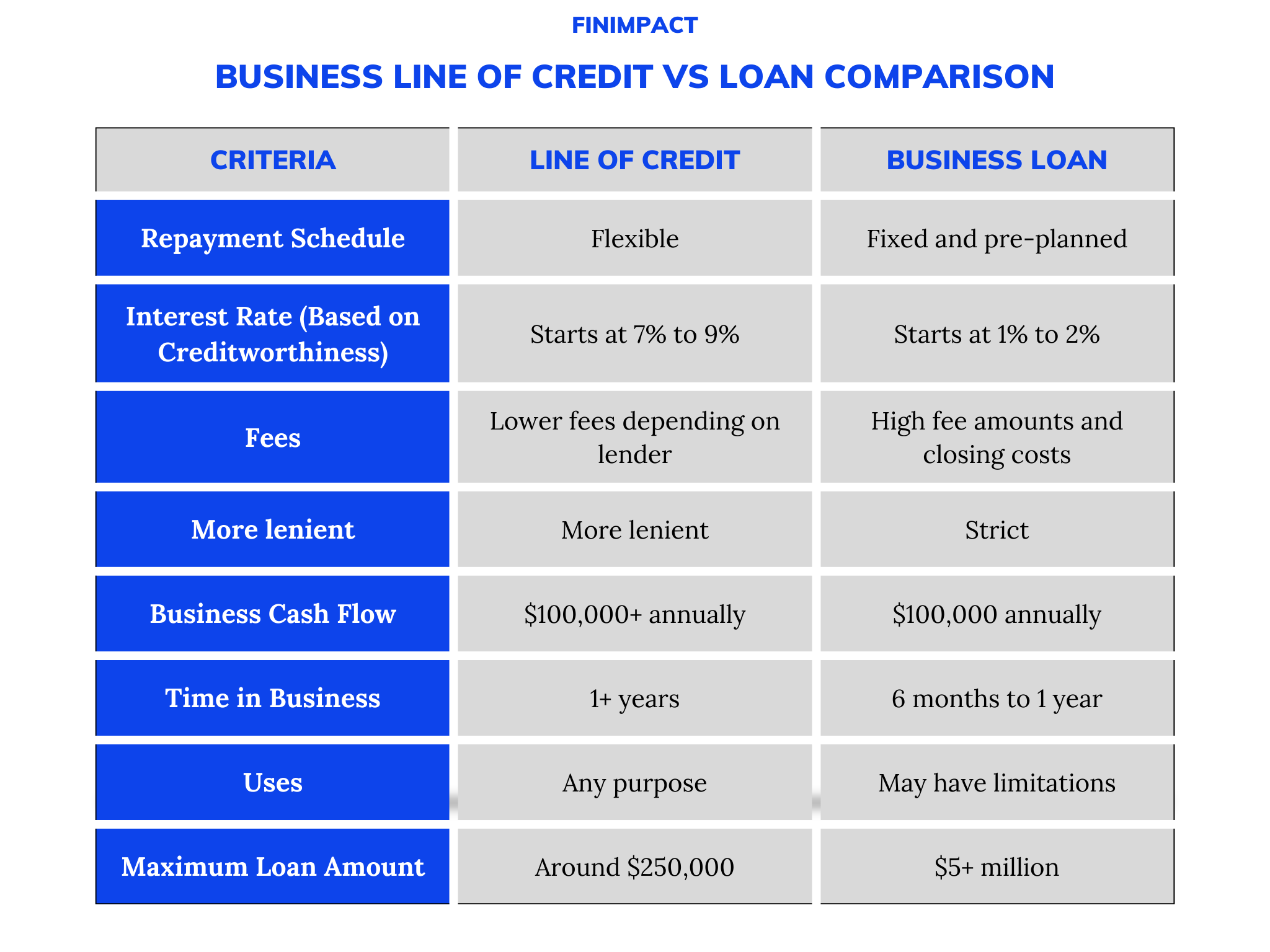

Revolving credit vs. non revolving credit Credit cards and lines of credit are both examples of revolving credit. Instalment loans are non-revolving, because. As you repay your outstanding balance, the amount of available credit is replenished – much like a credit card. This means you can borrow against it again if. Revolving credit remains open until the lender or borrower closes the account. A line of credit, on the other hand, can have an end date or terms for a time. Use the form below to calculate. Enter your loan information. Mortgages, Car Loans and Other Term Loans Calculator. A critical distinction from other financing forms such as term loans lies in its flexibility. Businesses can allocate these funds across various. With this loan, a borrower can draw money against the equity they have in their home. When applying for a HELOC, lenders typically request an appraisal to. However with non-revolving credit, the borrower can only access the loan once after which he/she is required to pay back overtime. 3. Rigid/Flexible Payment. Unlike an unsecured line of credit, though, an unsecured term loan will provide you with working capital in a lump sum. You then have a set period of time (the. Unlike revolving debt, you can't pay off a non-revolving debt to regain your credit line. Once it's paid off, the account closes. For example, installment loans. Revolving credit vs. non revolving credit Credit cards and lines of credit are both examples of revolving credit. Instalment loans are non-revolving, because. As you repay your outstanding balance, the amount of available credit is replenished – much like a credit card. This means you can borrow against it again if. Revolving credit remains open until the lender or borrower closes the account. A line of credit, on the other hand, can have an end date or terms for a time. Use the form below to calculate. Enter your loan information. Mortgages, Car Loans and Other Term Loans Calculator. A critical distinction from other financing forms such as term loans lies in its flexibility. Businesses can allocate these funds across various. With this loan, a borrower can draw money against the equity they have in their home. When applying for a HELOC, lenders typically request an appraisal to. However with non-revolving credit, the borrower can only access the loan once after which he/she is required to pay back overtime. 3. Rigid/Flexible Payment. Unlike an unsecured line of credit, though, an unsecured term loan will provide you with working capital in a lump sum. You then have a set period of time (the. Unlike revolving debt, you can't pay off a non-revolving debt to regain your credit line. Once it's paid off, the account closes. For example, installment loans.

Both short-term and long-term loans have an application process, including checking your credit score. But long-term loans often have additional requirements. Unlike revolver loans, term loans provide a lump sum that must be repaid over a predetermined period, along with interest. They are commonly. On the other hand, a revolving credit line offers flexible repayment terms. Unlike a term loan, if a business has a slow month it can pay the minimum amount due. A personal line of credit is a type of financing that you can borrow from over and over again. You must stay within your credit limit. Loans have what's called a non-revolving credit limit, which means the borrower has access to the funds only once, and then they make principal and interest. There are different types of bank loans. The revolving loan is one that can be drawn down and repaid several times throughout the period much like an. Unlike a term loan that provides a lump sum of money, an equipment line of credit offers a limit up to which a business can borrow. This flexible access to. Line of Credit – the line of credit facility established pursuant to the terms of this Agreement, the Note and any other Loan Document. SECTION V. A personal line of credit is a revolving source of funds, up to an approved amount. You access the funds only when you need them. Any principal amount you repay. Generally, the interest rate is higher on a term loan than a line of credit. “But it still depends on the financial strength of the company and the level of. If the borrower repays part of the non-revolving loan, this does not increase the disbursement limit. Unlike revolving and term loans, a non-revolving credit. With this loan, a borrower can draw money against the equity they have in their home. When applying for a HELOC, lenders typically request an appraisal to. Non-revolving credit is a credit agreement who once repaid, cannot be used anymore. Some types of bank loans applying non-revolving credit scheme are: Working. A critical distinction from other financing forms such as term loans lies in its flexibility. Businesses can allocate these funds across various. In providing formula based revolving lines of credit, the Bank establishes a “formula” which defines a borrowing base under which the business borrower can. Non-banking finance companies (NBFCs) typically extend personal loans as revolving lines of credit via online apps. However, the question is whether a. Unlike a conventional loan a HELOC is a revolving line of credit, allowing you to borrow more than once. In that way, it's like a credit card, except with a. A revolving credit facility is a line of credit that is arranged between a bank and a business. It comes with an established maximum amount. This memo item includes loan balances that are not included in the nonrevolving credit balances. For additional information, see public documentation. Data for. Non-revolving credit. BusinesFlex Line of credit. The BusinessFlex Line of Credit is a short-term financing product that provides quick access to funds to.

Td Stock Trade Account

Stocks are one of the most common investments. Learn what stocks are, the risks associated with them, and the role they can play in an investment portfolio. TD Ameritrade sets a high bar for trading and investing instruction. In addition to a robust library of educational content, TD Ameritrade has a wide selection. Work towards your trading and investing goals with TD Direct Investing trading platforms, including an app, for a variety of trades and range of investment. TD Waterhouse ; Greenline Investor Services, Waterhouse Securities · Subsidiary · Financial services · Toronto, Ontario, Canada · TD Direct Investing; TD Wealth. You want to take money out of your TFSA. Here's everything you need to know about withdrawal fees, penalties, taxes, and more. Investing. How to Buy Stocks in. Day Trading Buying Power is given to margin accounts that have completed more than 3 day trades in a 5 rolling business day period, and have a start of day. As a TD Easy Trade client, you're given 50 commission-free stock trades each year. TD ETF trades are commission-free all the time and are not counted as part of. TD Ameritrade was a stockbroker that offered an electronic trading platform for the trade of financial assets. The company was founded in as First. TD Securities is a leading investment bank that provides corporate and investment banking and capital markets products and services to corporate. Stocks are one of the most common investments. Learn what stocks are, the risks associated with them, and the role they can play in an investment portfolio. TD Ameritrade sets a high bar for trading and investing instruction. In addition to a robust library of educational content, TD Ameritrade has a wide selection. Work towards your trading and investing goals with TD Direct Investing trading platforms, including an app, for a variety of trades and range of investment. TD Waterhouse ; Greenline Investor Services, Waterhouse Securities · Subsidiary · Financial services · Toronto, Ontario, Canada · TD Direct Investing; TD Wealth. You want to take money out of your TFSA. Here's everything you need to know about withdrawal fees, penalties, taxes, and more. Investing. How to Buy Stocks in. Day Trading Buying Power is given to margin accounts that have completed more than 3 day trades in a 5 rolling business day period, and have a start of day. As a TD Easy Trade client, you're given 50 commission-free stock trades each year. TD ETF trades are commission-free all the time and are not counted as part of. TD Ameritrade was a stockbroker that offered an electronic trading platform for the trade of financial assets. The company was founded in as First. TD Securities is a leading investment bank that provides corporate and investment banking and capital markets products and services to corporate.

Our online trading platform allows you to execute, track and monitor transactions from the comfort of your home or office. Like competitors, TD Ameritrade offers commission-free stock and ETF trading. There are no minimum investments or account fees. No-transaction-fee and zero-. A leading full-service investment bank with global and M&A advisory, capital markets, equity execution and industry-leading research capabilities. The top online brokerage accounts for trading stocks in August An online broker is a financial institution that allows you to purchase securities. Introducing a new way trade & invest. TD Easy Trade helps you easily trade & start your investing journey by tracking your progress towards your goals. TD Ameritrade is a full service brokerage, offering online services for most types of investors. There are no minimum requirements to open an account. You want to take money out of your TFSA. Here's everything you need to know about withdrawal fees, penalties, taxes, and more. Investing. How to Buy Stocks in. From talking to the TD rep for some account details on my direct investing account, he suggested I consider TD Easy Trade stock. I am. Our full-featured brokerage account unlocks what you need to grow as an investor—from $0 commission trades, to our powerful research and tools. The TD Ameritrade SDBA can only be funded through transfers from one or more of the Plan's core investment options. The following securities and transactions. Play the TD Bank Virtual Stock Market Game, a free stock market simulator that helps students learn about investing in real stocks without using real money. Your first 50 stock trades each year are commission-free. After 50 trades, the standard $ USD/CAD commission fee is charged on all stock trades. You don't. SECURITIES AND OTHER INVESTMENT AND INSURANCE PRODUCTS ARE: NOT A DEPOSIT; NOT FDIC INSURED; NOT INSURED BY ANY FEDERAL GOVERNMENT AGENCY; NOT GUARANTEED BY TD. Fidelity also offers fractional share trading, which allows users to trade and invest Get One Free Stock (after linking a bank account; choose from about How much to invest in TD Stock:Decide how much to invest in TD stock. · Open account:To buy TD stock you need to open a brokerage account. · Buy TD Stock Using. Share your videos with friends, family, and the world. Service charges apply for trades placed through a broker ($25). Stock plan account transactions are subject to a separate commission schedule. All fees and. If you want to do margin or options trading, you'll need at least $2, in your account. You will also pay a flat fee of $ per trade, no matter how many. SECURITIES AND OTHER INVESTMENT AND INSURANCE PRODUCTS ARE: NOT A DEPOSIT; NOT FDIC INSURED; NOT INSURED BY ANY FEDERAL GOVERNMENT AGENCY; NOT GUARANTEED BY TD. Options are $$ per contract, depending on trading volume. Read full review · Open an Account. E*TRADE vs. TD Ameritrade.

American Water Sewer Line Protection Plan

Have peace of mind knowing that your outside water and sewer/septic service lines are covered if they need unexpected repairs. American Water Resources (AWR) offers service line protection contracts to homeowners in 43 states and Washington, DC, and currently services more than 2. Convenient payments — the program cost is added directly to your DEP water and sewer bill · Unlimited protection for covered water and sewer line repairs caused. Our protection plans can save you thousands · Water Line · Sewer Line · In-Home Plumbing · Combo Plans. Homeowners can get combination water and sewer line protection for just $ per month. It offers 24/7 call support, unlimited protection, unlimited service. Residents are contacted directly by Service Line Warranties of America regarding the Sewer Line Warranty program. For more information on this program, call. The City offers a voluntary Water and Sewer Line Protection Program in partnership with American Water Resources (AWR), designed to help protect New York City. The water line and sewer line protection program is being made available to Philadelphia homeowners for $ a month through a city partnership with American. Have peace of mind knowing that your outside water and sewer/septic service lines are covered if they need unexpected repairs. Have peace of mind knowing that your outside water and sewer/septic service lines are covered if they need unexpected repairs. American Water Resources (AWR) offers service line protection contracts to homeowners in 43 states and Washington, DC, and currently services more than 2. Convenient payments — the program cost is added directly to your DEP water and sewer bill · Unlimited protection for covered water and sewer line repairs caused. Our protection plans can save you thousands · Water Line · Sewer Line · In-Home Plumbing · Combo Plans. Homeowners can get combination water and sewer line protection for just $ per month. It offers 24/7 call support, unlimited protection, unlimited service. Residents are contacted directly by Service Line Warranties of America regarding the Sewer Line Warranty program. For more information on this program, call. The City offers a voluntary Water and Sewer Line Protection Program in partnership with American Water Resources (AWR), designed to help protect New York City. The water line and sewer line protection program is being made available to Philadelphia homeowners for $ a month through a city partnership with American. Have peace of mind knowing that your outside water and sewer/septic service lines are covered if they need unexpected repairs.

“Over the past three years, more than , water-related repairs have been completed through the National League of Cities Service Line Warranty Program [a. This past year, City Hall sought the help of American Water Resources, now program called the Water Line and Sewer Line Protection Program. For a. These plans are NOT offered by the utility but by a non utility regulated affiliate (they are insurance regulated) of them. To my knowledge the. We offer a voluntary water and sewer service line protection program to protect our customers from unexpected service line repair costs. These plans are NOT offered by the utility but by a non utility regulated affiliate (they are insurance regulated) of them. To my knowledge the. There's a better way to pay for water, sewer and other service line repairs. All you need is a repair plan from Service Line Warranties of America. Optional plans from SLWA can help protect you from the potentially expensive repair costs of water and sewer lines inside and outside your home. How EPWater. Service lines bring water and power to homes, and they can take sewage away. Service line insurance is an optional coverage that helps pay for repairs and. This voluntary water and sewer line warranty program is available to homeowners within All of the mailings are paid for by Service Line Warranties of America. protection plan and reimbursed the $ it cost to fix the sewer line. Customer response. 07/29/ [A default letter is provided here which indicates. Service lines bring water and power to homes, and they can take sewage away. Service line insurance is an optional coverage that helps pay for repairs and. For information regarding a Sewer Line Protection Program, please contact the Missouri American Water Resources website at essaytogetherguam.online or by calling. The Water Service Line Protection Plan covers repairs or replacement of a leaking water line that runs from the street to your house to either the shut-off. The warranty protection repairs the portion of the water or sewer line that runs between the exterior of the home to the public utility connection. This program. The city recognizes Service Line Warranties of America as a preferred company for water and sewer line insurance. Insurance for the water line and the sewer. A growing number of companies - including utilities and third-party vendors - offer “line protection programs.” For a monthly fee, these programs may act as a. DWSD endorses the warranty program provided by American Water Resources. What Is This Agreement? This is an Agreement (“Agreement”) between American. Water Resources, LLC (“AWR”) and the person named in. BBB accredited since 10/1/ Water and Sewer Line Protection in Mount Laurel, NJ. See BBB rating, reviews, complaints, get a quote & more. The water and sewer service lines on your property are your financial responsibility, and they can fail unexpectedly. Aqua partners with HomeServe so we can.

What Can A Financial Advisor Do For You

As a financial planner, you might work in a bank or brokerage firm or settle into a niche in a smaller firm or as an independent consultant. You could also. Being an independent financial advisor can be a rewarding and satisfying career choice. But before you decide, there are some things to think about. First. A financial advisor can help you cope with the fallout of life's unexpected events and adapt your strategy to stay on track. Financial planners are highly sought-after and have a diverse range of professional opportunities, including: Retail banking; Wealth management; Boutique. Financial advisors can also help you plan for retirement, manage your investments, refine your budget, pay down debt, update your insurance coverage and create. A financial advisor can help you create college savings, a retirement plan, and estate needs that fit your needs and lifestyle. 7. Review and update your plan. A financial advisor provides financial advice or guidance to customers for compensation. Financial advisors (sometimes spelled as advisers) can provide many. Long before you begin house hunting, an advisor can offer help as you figure out how much debt you can take on, how much money to put toward a down payment and. Your advisor is your financial partner. They will answer your questions and help you understand how investing can help you achieve your goals. As a financial planner, you might work in a bank or brokerage firm or settle into a niche in a smaller firm or as an independent consultant. You could also. Being an independent financial advisor can be a rewarding and satisfying career choice. But before you decide, there are some things to think about. First. A financial advisor can help you cope with the fallout of life's unexpected events and adapt your strategy to stay on track. Financial planners are highly sought-after and have a diverse range of professional opportunities, including: Retail banking; Wealth management; Boutique. Financial advisors can also help you plan for retirement, manage your investments, refine your budget, pay down debt, update your insurance coverage and create. A financial advisor can help you create college savings, a retirement plan, and estate needs that fit your needs and lifestyle. 7. Review and update your plan. A financial advisor provides financial advice or guidance to customers for compensation. Financial advisors (sometimes spelled as advisers) can provide many. Long before you begin house hunting, an advisor can offer help as you figure out how much debt you can take on, how much money to put toward a down payment and. Your advisor is your financial partner. They will answer your questions and help you understand how investing can help you achieve your goals.

New graduates and people in their early careers should look for financial planning support as soon as they start earning an income. Individuals with math, networking, and logic skills may enjoy financial planner roles. You can start on the path of becoming a financial advisor by. Individuals with math, networking, and logic skills may enjoy financial planner roles. You can start on the path of becoming a financial advisor by. A financial advisor is an investment professional who can assist you in creating and implementing a personalized plan to pursue your financial goals, from. A knowledgeable, honest planner can help you avoid the big mistakes--tax traps, estate mishaps, errors in timing withdrawals, behavioral finance. As you plan your investments, a financial advisor can identify which accounts are taxable, as well as help you navigate changing tax laws and regulations—to. This might include advice about budgeting, investing, super, retirement planning, estate planning, insurance and taxation. 2. Choose the right financial advice. It's also about helping you pursue your goals, grow your wealth, and take care of the people who matter most to you. Here are 3 ways a good advisor can help. Registered investment adviser (RIAs) provide ongoing advice to their clients. In general, RIAs use the same investments offered by the registered representative. FINANCIAL PLANNING. 1. Cares more about you and your money than anyone who doesn't share your last name. 2. Guides you to think about areas of your. Financial Adviser will help you in understanding of the products, explain risk and return involved in the product, will help you with risk. Personal financial advisors assess the financial needs of individuals and help them with decisions on investments (such as stocks and bonds), tax laws, and. Your Financial Advisor can also work with your tax and legal advisors to help create a personalized plan that suggests ways to help reduce your taxes. Independent advisors can help investors address the variety of complex investment needs that arise when you accumulate significant wealth. While specific. A financial adviser can help you set financial goals so you feel confident that your future plans are achievable. If you're not on track to achieving your goals. A financial adviser will make a detailed assessment of your attitude to risk before making recommendations. They will also ensure you don't put all your eggs in. But how could a dedicated financial advisor help you achieve more? Answer 3 questions to learn how an advisor can add value to your situation. Investment Advisors can further their training and obtain other designations, such as Certified Financial Planner, or Mutual Fund Representative. What does an. A financial advisor can help you develop a personalized strategy to achieve your goals, build wealth and make financial decisions that support your progress. Financial advisors are professionals who can help you manage and maintain your finances, including your wealth, savings, and investments.

What Is Pre Qualified Vs Pre Approved

:max_bytes(150000):strip_icc()/dotdash-prequalified-approved-Final-0ec9b95c27ba4354a00f49817d0810dd.jpg)

Pre-qualification and pre-approval have two different meanings, even though they may sound almost the same. Being prequalified implies that a lender has assessed your financial situation and believes you are likely to be approved for a loan up to a specific amount. Unlike prequalification, preapproval is a more specific estimate of what you could borrow from your lender and requires documents such as your W2, recent pay. A pre-approval is usually only good for 90 days and it will likely show as an inquiry on your credit report, so consider holding off on applying for pre-. A mortgage Pre-Approval is a much more robust review of your credit worthiness than a Pre-Qualification. The pre-qualification indicates that you are likely to qualify for the loan. But when you want to finalize the loan, you'll need to submit a formal application. A mortgage pre-approval or pre-qualification will help you figure out how much home you can actually afford, so you can house hunt with confidence and make an. Securing a mortgage pre-approval letter or getting pre-qualified by a lender are effective ways of reducing the stress. But how do they differ, and is one. Pre-qualifications are conditional and involve the lender reviewing a borrower's creditworthiness before granting a pre-approval. Lenders generally use this as. Pre-qualification and pre-approval have two different meanings, even though they may sound almost the same. Being prequalified implies that a lender has assessed your financial situation and believes you are likely to be approved for a loan up to a specific amount. Unlike prequalification, preapproval is a more specific estimate of what you could borrow from your lender and requires documents such as your W2, recent pay. A pre-approval is usually only good for 90 days and it will likely show as an inquiry on your credit report, so consider holding off on applying for pre-. A mortgage Pre-Approval is a much more robust review of your credit worthiness than a Pre-Qualification. The pre-qualification indicates that you are likely to qualify for the loan. But when you want to finalize the loan, you'll need to submit a formal application. A mortgage pre-approval or pre-qualification will help you figure out how much home you can actually afford, so you can house hunt with confidence and make an. Securing a mortgage pre-approval letter or getting pre-qualified by a lender are effective ways of reducing the stress. But how do they differ, and is one. Pre-qualifications are conditional and involve the lender reviewing a borrower's creditworthiness before granting a pre-approval. Lenders generally use this as.

A mortgage pre-approval provides a fairly accurate estimate of a homebuyer's purchasing power, as it includes the maximum loan amount and interest rate the. Pre-qualification is just the beginning. It provides you a rough indication of the size of loan you might be eligible for. The second step is pre-approval. What Does it Mean to be Pre-Qualified? Being pre-qualified means a lender has decided you will likely be approved for a loan up to a certain amount, based on. A pre-qualification will not affect your credit score, as the lender only performs a soft credit inquiry to determine whether or not you qualify for a loan. Pre-qualification refers to an estimate for financing given by a lender based on information provided by a potential borrower. For this reason, pre-qualification doesn't carry the same gravitas as pre-approval. Your pre-qualified amount can help you determine your price range, but it's. Homebuyers who get pre-approved have submitted documentation and their application has been put through a rigorous process. Pre-qualification is only a. A pre-qualification is a good starting place because it doesn't include an inquiry into your credit report and doesn't ask for proof of assets, income or debts. A mortgage pre-qualification is an initial assessment of a potential buyer, and often it's not worth the paper it's written on. But a pre-approval goes deeper. A pre-qualification is an estimate since your information isn't reviewed in-depth. A pre-approval will tell you what you will actually be provided were you to. When a borrower (you) applies for a home loan, the information you and your co-borrower, if any, submit starts the pre-qualification process. This process. Being prequalified implies that a lender has assessed your financial situation and believes you are likely to be approved for a loan up to a specific amount. Think about it this way. Pre-qualification is meant for you. Pre-approval is meant for sellers. When you have a pre-approval letter to show a home seller, it. Of the two, a pre-approval is a better indicator of your ability to buy a home. Lenders typically offer an interest rate for days when they pre-approve you. Pre-qualification gives you a rough estimate of how much you might be able to borrow. It's a relatively quick and informal process, often done online or over. A preapproval is not a commitment to lend. Nor is it any commitment by you to actually use that particular lender for your mortgage. It's. A mortgage pre-approval provides a fairly accurate estimate of a homebuyer's purchasing power, as it includes the maximum loan amount and interest rate the. Pre-qualification is the act of working with a lender to see what kind of mortgage you might qualify for based on your current personal finances. pre-approval, mortgage pre-qualification, or possibly even both. So what does it mean to get pre-approved vs. get pre-qualified for a mortgage, and what's.

Galliard Retirement Income Fund

The Fund is designed for investors seeking more income than money market funds without the price fluctuation of stock or bond funds. INVESTMENT STRATEGY. The Fund's underlying fixed income strategy is managed in a conservative style that utilizes a disciplined value investing process to. Galliard Managed Income Fund. 1: Returns for periods less than one year are not annualized. 2: Returns designated as “before investment management fees” include. Get Galliard Retirement Income Fund CL F35 (WGRIRX:NASDAQ) real-time stock quotes, news, price and financial information from CNBC. The Galliard Stable Asset Return Fund, managed by Galliard Capital Management, is primarily comprised of investment contracts2 issued by financial. Find the latest performance data chart, historical data and news for CIT: Galliard Retirement Income Fund Class 45 (WGRIFX) at essaytogetherguam.online Find the latest performance data chart, historical data and news for CIT: Galliard Retirement Income Fund Class 35 (WGRITX) at essaytogetherguam.online The Fund is designed for investors seeking more income than money market funds without the price fluctuation of stock or bond funds. Galliard Managed Income. AST Collective Investment Trust Galliard Retirement Income Fund ; Fund. WGRITX ; Price as of: SEP 13, PM EDT. $ + $ + % ; Primary Theme. The Fund is designed for investors seeking more income than money market funds without the price fluctuation of stock or bond funds. INVESTMENT STRATEGY. The Fund's underlying fixed income strategy is managed in a conservative style that utilizes a disciplined value investing process to. Galliard Managed Income Fund. 1: Returns for periods less than one year are not annualized. 2: Returns designated as “before investment management fees” include. Get Galliard Retirement Income Fund CL F35 (WGRIRX:NASDAQ) real-time stock quotes, news, price and financial information from CNBC. The Galliard Stable Asset Return Fund, managed by Galliard Capital Management, is primarily comprised of investment contracts2 issued by financial. Find the latest performance data chart, historical data and news for CIT: Galliard Retirement Income Fund Class 45 (WGRIFX) at essaytogetherguam.online Find the latest performance data chart, historical data and news for CIT: Galliard Retirement Income Fund Class 35 (WGRITX) at essaytogetherguam.online The Fund is designed for investors seeking more income than money market funds without the price fluctuation of stock or bond funds. Galliard Managed Income. AST Collective Investment Trust Galliard Retirement Income Fund ; Fund. WGRITX ; Price as of: SEP 13, PM EDT. $ + $ + % ; Primary Theme.

Galliard Retirement Income Fund CL Morningstar Profile (6/30/).

GALLIARD RETIREMENT INCOME FUND CL Performance charts including intraday, historical charts and prices and keydata. GALLIARD RETIREMENT INCOME FUND CL F Performance charts including intraday, historical charts and prices and keydata. Schwab Managed Retirement Trust Funds – These collective common trust funds are retirement trust funds Galliard Retirement Income Fund – This fund invests in. The Fund's net expense ratio is compared to the Morningstar. Target-Date Funds. The number in parentheses indicates the Fund's percentile ranking for. Nasdaq - Delayed Quote • USD. AST Collective Investment Trust - Galliard Retirement Income Fund (WGRITX). Follow. + (+%). At close: PM EDT. Galliard Retirement Income Fund is an open-end fund incorporated in the United States that will be invested in the Galliard Managed Income Fund. This. A high-level overview of AST Collective Investment Trust - Galliard Retirement Income Fund (WGRIOX) stock. Stay up to date on the latest stock price, chart. Main Menu · Galliard Stable Return Fund · Galliard Managed Income Fund · Stable Value Composite · Fixed Income Collective Funds · Galliard Fixed Income Composites. A high-level overview of AST Collective Investment Trust - Galliard Retirement Income Fund (WGRISX) stock. Stay up to date on the latest stock price, chart. Get WGRITX mutual fund information for Galliard-Retirement-Income-Fund, including a fund overview,, Morningstar summary, tax analysis, sector allocation. WGRITX | A complete CIT Galliard Retirement Income Fund Cl 35 mutual fund overview by MarketWatch. View mutual fund news, mutual fund market and mutual fund. Nasdaq - Delayed Quote • USD. AST Collective Investment Trust - Galliard Retirement Income Fund (WGRIFX). Follow. + (+%). At close: AM EDT. Fund Details ; Legal Name. AST Collective Investment Trust Galliard Retirement Income Fund Fee ; Fund Family Name. Wilmington Trust, N.A ; Inception Date. Aug. WGRIFX | A complete CIT Galliard Retirement Income Fund Cl 45 mutual fund overview by MarketWatch. View mutual fund news, mutual fund market and mutual fund. Complete CIT Galliard Retirement Income Fund Fee Cl F35 funds overview by Barron's. View the WGRIRX funds market news. Performance charts for Galliard Retirement Income Fund (WGRITX) including intraday, historical and comparison charts, technical analysis and trend lines. Real time AST Collective Investment Trust - Galliard Retirement Income Fund (WGRIRX) price, charts, news, information and analysis of AST Collective. Disclosures under the Employee Retirement Income Security Act of have been omitted because they are not applicable. 2. REPORT OF INDEPENDENT REGISTERED. Complete CIT Galliard Retirement Income Fund Cl 35 funds overview by Barron's. View the WGRITX funds market news. Get Galliard Retirement Income Fund CL F45 (WGRIOX:NASDAQ) real-time stock quotes, news, price and financial information from CNBC.

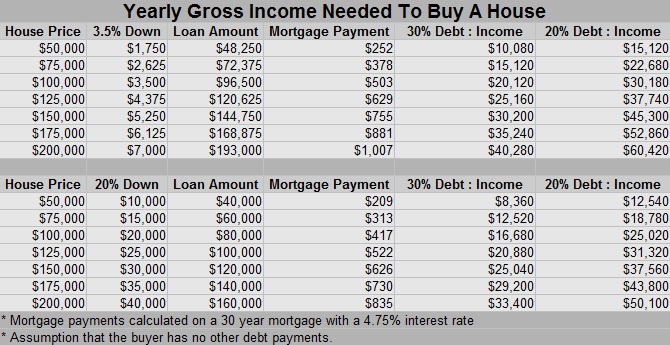

What House Can I Buy With My Salary

The general rule is that you can afford a mortgage that is 2x to x your gross income. · Total monthly mortgage payments are typically made up of four. As a general rule, you should look at spending no more than a third of your monthly income (after tax and deductions) towards your monthly bond repayments. Make. Discover how much house you can afford based on your income, and calculate your monthly payments to determine your price range and home loan options. If you're debt-free, your monthly housing payment can go as high as $1, on an income of $50, per year. Author. By Amy Fontinelle. Amy Fontinelle. You can afford a home worth up to $, with a total monthly payment of $1, ; LOAN & BORROWER INFO. Calculate affordability by · Annual gross income · Must. Mortgage lenders may run your financial information through a few different calculations when determining how much house you can afford based on income. You can. One rule of thumb is to aim for a home that costs about two-and-a-half times your gross annual salary. 3 times your annual income would be fine. $k×3= $, You probably could go as high as 5 times annual income, but with current interest. Free house affordability calculator to estimate an affordable house price based on factors such as income, debt, down payment, or simply budget. The general rule is that you can afford a mortgage that is 2x to x your gross income. · Total monthly mortgage payments are typically made up of four. As a general rule, you should look at spending no more than a third of your monthly income (after tax and deductions) towards your monthly bond repayments. Make. Discover how much house you can afford based on your income, and calculate your monthly payments to determine your price range and home loan options. If you're debt-free, your monthly housing payment can go as high as $1, on an income of $50, per year. Author. By Amy Fontinelle. Amy Fontinelle. You can afford a home worth up to $, with a total monthly payment of $1, ; LOAN & BORROWER INFO. Calculate affordability by · Annual gross income · Must. Mortgage lenders may run your financial information through a few different calculations when determining how much house you can afford based on income. You can. One rule of thumb is to aim for a home that costs about two-and-a-half times your gross annual salary. 3 times your annual income would be fine. $k×3= $, You probably could go as high as 5 times annual income, but with current interest. Free house affordability calculator to estimate an affordable house price based on factors such as income, debt, down payment, or simply budget.

What mortgage can I afford? The most you can borrow is usually capped at four-and-a-half times your annual income. It's tempting to get a mortgage for as much. Many people will tell you that the rule of thumb is you can afford a mortgage that is two to two-and-a-half times your gross (aka before taxes) annual salary. How much house can I afford? · A good rule of thumb to how much you can afford is around times your annual income" · Let's talk about income · How much debt. The general guideline is that a mortgage should be two to times your annual salary. A $60, salary equates to a mortgage between $, and $, Our home affordability tool calculates how much house you can afford based on several key inputs: your income, savings and monthly debt obligations. Most mortgage lenders will consider lending 4 to times a borrower's income, adhering to affordability criteria. Under certain conditions, this can extend to. Find out what house price you could afford with our home purchase calculator, we'll tell you what house price you could afford based on your income and. First, a standard rule for lenders is that your monthly housing payment should not take up more than 28% of your gross monthly income. That way you'll have. You should buy a property that won't take anything more than 28 percent of your gross monthly income. For example, if you earned $, a year, it would be no. Depending on your monthly liabilities and the property taxes, insurance, hoa cost in your area, you would qualify for approximately $k. Use our free mortgage affordability calculator to estimate how much house you can afford based on your monthly income, expenses and specified mortgage rate. How Much Can You Afford? ; LOAN & BORROWER INFO. Calculate affordability by · Annual gross income · Must be between $0 and $,, · Annual gross income ; TAXES. To find out how much house you can afford, multiply your 5% down payment by 20 to find the price of the home you'll be able to buy (5% down payment x 20 = %. You can reverse the calculation and multiply your income by to determine a target mortgage payment. 36% is the limit to your total debt, including the. The short answer is generally you should consider mortgage loans with a monthly payment that is 28% or less of your pre-tax monthly salary. As an example, let's. Most financial advisors recommend spending no more than 25% to 28% of your monthly income on housing costs. Add up your total household income and multiply it. Many people will tell you that the rule of thumb is you can afford a mortgage that is two to two-and-a-half times your gross (aka before taxes) annual salary. Lenders look at a debt-to-income (DTI) ratio when they consider your application for a mortgage loan. A DTI ratio is your monthly expenses compared to your. What's the Rule of Thumb for Mortgage Affordability? · Multiply Your Annual Income by · The 28/36 Rule. “Other rules say you should aim to spend less than 28% of your pre-tax monthly income on a mortgage,” says Hill. Known as the "28/36 rule," this can be a solid.

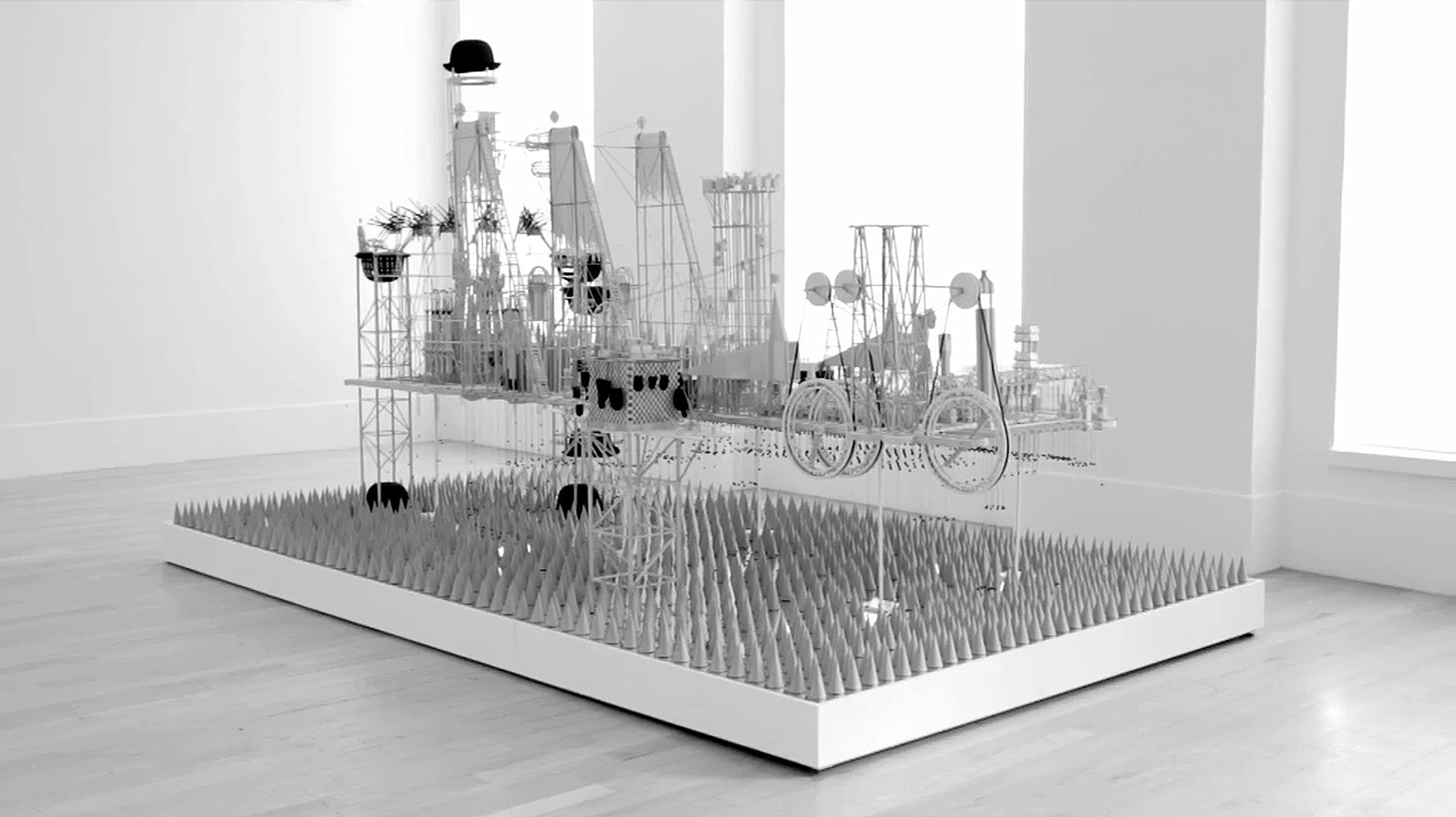

Platform Gallery

a solo exhibition in PLATFORM's Gallery 2. Applications are due 31 May, at midnight CST. Submissions must include a bio, CV, artist statement ( words. Art world professionals using the platform to grow their businesses. +. Live websites helping galleries, artists, art advisories and collections grow online. PLATFORM · centre for photographic + digital arts · Click here to visit our new website. Welcome to The Community Gallery: A Public Perspectives Platform. This collaborative online exhibition space explores big ideas through multiple perspectives. More than just a gallery sharing platform. Share, deliver and sell your work online with a modern gallery design that looks and feels like you. The Platform Gallery provides a unique market place for handmade crafts from across the UK. Visit us to see contemporary craft exhibitions, buy stunning. Platform Gallery and Visitor Information Centre The Platform Gallery provides a unique market place for handmade crafts from across the UK. About Platform Galeri. Located in the basement of Betws-y-Coed Railway Station, the gallery houses the work of owner and award winning photographer Jacha. The IHC announces a call for submissions for artwork to be included in its Platform Gallery, an online exhibition and public gallery space on the 6th floor of. a solo exhibition in PLATFORM's Gallery 2. Applications are due 31 May, at midnight CST. Submissions must include a bio, CV, artist statement ( words. Art world professionals using the platform to grow their businesses. +. Live websites helping galleries, artists, art advisories and collections grow online. PLATFORM · centre for photographic + digital arts · Click here to visit our new website. Welcome to The Community Gallery: A Public Perspectives Platform. This collaborative online exhibition space explores big ideas through multiple perspectives. More than just a gallery sharing platform. Share, deliver and sell your work online with a modern gallery design that looks and feels like you. The Platform Gallery provides a unique market place for handmade crafts from across the UK. Visit us to see contemporary craft exhibitions, buy stunning. Platform Gallery and Visitor Information Centre The Platform Gallery provides a unique market place for handmade crafts from across the UK. About Platform Galeri. Located in the basement of Betws-y-Coed Railway Station, the gallery houses the work of owner and award winning photographer Jacha. The IHC announces a call for submissions for artwork to be included in its Platform Gallery, an online exhibition and public gallery space on the 6th floor of.

The Uno Platform Gallery application. Contribute to unoplatform/essaytogetherguam.onliney development by creating an account on GitHub. Who is Platform Gallery. Platform Gallery was founded in by Lydia Pettit and Abigail Parrish on the first floor of Platform Arts Center. About Platform Galeri. Located in the basement of Betws-y-Coed Railway Station, the gallery houses the work of owner and award winning photographer Jacha. The Platform showcases the best fine art that KZN has to offer. From oil paintings to pencil sketches and sculptures, there is a little something for. We started Platform as determined 22 year-olds with hopes of creating an accessible and inclusive gallery for emerging and established artists alike. Big news for console players during Maxis Monthly today! The team is working on bringing The Gallery to consoles!Not only that, but the Gallery will be. A FANCY EVENING AFFAIR Artist meet the Audience. OPENING NIGHT ON FEBRUARY 1. POP-UP GALLERY IN BARCELONA. Emerging artist to watch. WHY WE LOVE FRIEZE. to the platform, the literal platform for young artists. we bring vcrb gallery | the platform. De Burburestraat 14 Antwerp, BE we're on. Sur Gallery is Toronto's first gallery space dedicated to the implementation of art projects, which showcase and promote contemporary Latin American. PLATFORM ONE. GALLERY, SHOP AND STUDIO SPACES IN THE HEART OF TODMORDEN. PROVIDING AFFORDABLE STUDIO RATES, LOCATION SPOT FOR EXHIBITIONS, ARTISTS AND WORKSHOPS. Followers, Following, Posts - Platform Gallery (@platformgalleryclitheroe) on Instagram: "A dynamic space for contemporary craft in Clitheroe. Platform Gallery Exhibition: Too Much Information The Platform exhibition engages with the IHC's public events series theme, Too Much. An open call to artists: After Walter Hopps returns in Platform Arts will hand over the control of their curated gallery program in an open-call. THE PLATFORM Gallery | 75 followers on LinkedIn. Launch pad for up-and-coming talent in the arts. | /THE PLATFORM is a launch pad for young up-and-coming. Set on a working station platform with 25+ years of experience in international and local contemporary art, Focus on sustainability, innovation and wellbeing. W Mulberry St, Baltimore, Maryland Art Gallery• posts. $$$$•Closed. + · TopRecentIn the area. This is a gallery containing images of revival platforms in Super Smash Flash 2. Before the release of va of the SSF2 Demo, all characters in Super Smash. HBIAMP Image and Video Gallery · Images taken in HBIAMP · Light Sheet Microscopy iDISCO mouse brain · More videos on YouTube. The Platform Gallery is a contemporary art gallery located in Helsinki city centre. The Platform Gallery offers unique cultural experiences and art exhibits. Platform Stockholm Is an arts organization based in Stockholm, Sweden, dedicated to the development of cultural production through building digital.