essaytogetherguam.online Learn

Learn

Best Place In Florida To Retire On A Budget

With its low cost of living, Kansas in general rates as one of our 10 best states for retirement. And the capital city is particularly affordable. The median. On Florida's Gulf Coast, near Alabama, Pensacola offers pristine beaches with white sand and stunning gulf views. When you're not relaxing on the beach, take a. The most affordable beach towns in Florida for retirees include Palm Bay, known for its lower cost of living and beautiful beaches. Other affordable options are. Texas tops - Texas has a nice mix of affordability, major airports and low tax rates, which make for enticing cities for retirees who love to travel. · Florida. 25 Best Places to Retire in Florida on a Budget · Boynton Beach · Cape Coral · Dade City · Daytona Beach · Delray Beach · Dunedin · Edgewater. Edgewater sits. On Top of the World Ocala is a premier retirement community located right in the heart of Florida. It's the perfect location for anyone hoping to leave the. One of the best places to retire in Florida is Punta Gorda, which is a relatively small and safe town. This town features a river with a waterfront park. Tallahassee is the perfect place for Florida retirees who want to avoid the big city hustle and bustle but still get to enjoy all the activities a larger. Punta Gorda has a reputation for being one of the most affordable retirement destinations along the southern Gulf Coast of Florida. Buying or renting homes can. With its low cost of living, Kansas in general rates as one of our 10 best states for retirement. And the capital city is particularly affordable. The median. On Florida's Gulf Coast, near Alabama, Pensacola offers pristine beaches with white sand and stunning gulf views. When you're not relaxing on the beach, take a. The most affordable beach towns in Florida for retirees include Palm Bay, known for its lower cost of living and beautiful beaches. Other affordable options are. Texas tops - Texas has a nice mix of affordability, major airports and low tax rates, which make for enticing cities for retirees who love to travel. · Florida. 25 Best Places to Retire in Florida on a Budget · Boynton Beach · Cape Coral · Dade City · Daytona Beach · Delray Beach · Dunedin · Edgewater. Edgewater sits. On Top of the World Ocala is a premier retirement community located right in the heart of Florida. It's the perfect location for anyone hoping to leave the. One of the best places to retire in Florida is Punta Gorda, which is a relatively small and safe town. This town features a river with a waterfront park. Tallahassee is the perfect place for Florida retirees who want to avoid the big city hustle and bustle but still get to enjoy all the activities a larger. Punta Gorda has a reputation for being one of the most affordable retirement destinations along the southern Gulf Coast of Florida. Buying or renting homes can.

Fort Myers, Florida is one of the top-rated places to retire in the United States. Why? It has fantastic, sunny weather. It also features charming shopping. The Best Places To Retire on $6, Per Month · Best for Year-Round Outdoor Recreation: Reno, Nevada · Best for Sunshine and Warm Weather: Orlando, Florida · Best. 15 Best Beach Towns in Florida to Retire. Retirement is all about getting to fulfill your life-long desires. · 1. Fernandina Beach · 2. St. · 3. Delray Beach · 4. view of destin beach with clear blue water and white sand best florida beach town fort. Right over the bridge from Fort Walton Beach is Okaloosa Island, where. 15 Best Places to Retire in Florida on a Budget · 1. Wauchula · 2. Inverness · 3. Sebring · 4. Crystal River · 5. Frostproof · 6. Palatka · 7. Lake Wales · 8. The most affordable beach towns in Florida for retirees include Palm Bay, known for its lower cost of living and beautiful beaches. Other affordable options are. Atmore. Living on the Alabama/Florida state line in Atmore offers some of the most peaceful, relaxing, and stress-free retirements ever. After. Delray is a very fun little beach town. I've lived here my entire life and it has grown tremendously. Real estate is not cheap here but. If you want to live in a beautiful oceanfront town that is off the beaten path, and will allow you to remain within your budget, then check out Largo. Seriously. #1. Valencia Bonita · #2. Nokomis Florida, Sarasota · #3. Cape Coral Florida · #4. Fort Myers Beach · #5. North Port Florida · The Bottom line. In a nutshell, Fort. Top reasons to retire in Florida · You'd be in good company · Florida is tax-friendly · Housing is relatively affordable · Florida has low property taxes · In-home. Fort Myers, Florida is one of the top-rated places to retire in the United States. Why? It has fantastic, sunny weather. It also features charming shopping. Housing costs, for example, can vary significantly between regions, underscoring the need for strategic location choices to balance your budget with your. Sarasota is the best place to retire in the US; some even compare it to a paradise. It offers a wide range of modern amenities, artistic attractions, and golf. Delray is a very fun little beach town. I've lived here my entire life and it has grown tremendously. Real estate is not cheap here but. Melbourne is both a great vacation spot and one of the most affordable beach towns in Florida—offering budget-friendly housing and a lower cost of living than. Florida and St. Pete are full of active living retirement communities where getting to know the other people in the community is a given, through meals and. For those debating retiring in Alabama v.s. Florida, the border town of Dothan offers the best of both worlds. You'll be just half an hour or so from the. South Florida is a perfect place to retire. With bright, sunny weather budget and what type of house you need (such as a single-story for mobility. Highly recommend the thomasville/moultrie area. I have family nearby and visit often. Very cute downtown area and not that touristy. Also, very.

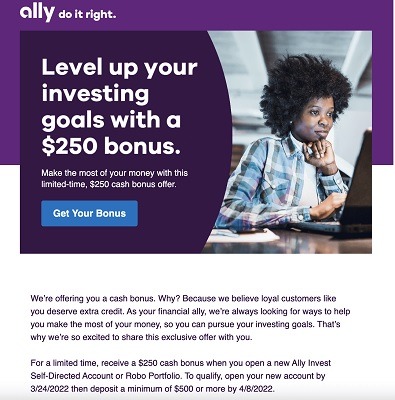

Ally Bank Saving Account Bonus

Ally Bank Up to $ Cash Bonus - Enroll and open a new Ally Bank Savings Account by 3/1/24 · Enroll and Open a new Ally bank Savings Account by. Plus, you can get paid up to two days early when your paycheck is set up through direct deposit. Ally Bank savings accounts and CDs. As of the publishing date. Ally Bank and Ally Auto customers can get a $ cash bonus when you open an eligible Self-Directed Trading or Robo Portfolio account, set up and complete at. Tap the button to select banks ; % APY $ ; National Average % APY $92 ; Ally Bank % APY $ ; American Express % APY $ ; Chase % APY $4. Get your $ We'll deposit your bonus within 30 days of your account receiving $1, in qualified direct deposits. For more details, check out our terms and. Get up to a $† on a Rewards Checking account when you use promo code RC But hurry – this bonus is limited time only. Simple Steps to Earn Your Checking. Ally Bank $ Checking Bonus Earn a $ bonus when you open a new Ally Bank Spending account and complete qualifying activities. Chase. Chase Savings · PNC Bank. Standard Savings · Bank of America. Advantage Savings · Ally Bank. Online Savings Account · Citibank. Citi Savings - Access Account. Online Savings - up to $ bonus (Expired) · Open a new Ally Online Savings Account with promo code GETPAID. · By November 4, move at least $1, from another. Ally Bank Up to $ Cash Bonus - Enroll and open a new Ally Bank Savings Account by 3/1/24 · Enroll and Open a new Ally bank Savings Account by. Plus, you can get paid up to two days early when your paycheck is set up through direct deposit. Ally Bank savings accounts and CDs. As of the publishing date. Ally Bank and Ally Auto customers can get a $ cash bonus when you open an eligible Self-Directed Trading or Robo Portfolio account, set up and complete at. Tap the button to select banks ; % APY $ ; National Average % APY $92 ; Ally Bank % APY $ ; American Express % APY $ ; Chase % APY $4. Get your $ We'll deposit your bonus within 30 days of your account receiving $1, in qualified direct deposits. For more details, check out our terms and. Get up to a $† on a Rewards Checking account when you use promo code RC But hurry – this bonus is limited time only. Simple Steps to Earn Your Checking. Ally Bank $ Checking Bonus Earn a $ bonus when you open a new Ally Bank Spending account and complete qualifying activities. Chase. Chase Savings · PNC Bank. Standard Savings · Bank of America. Advantage Savings · Ally Bank. Online Savings Account · Citibank. Citi Savings - Access Account. Online Savings - up to $ bonus (Expired) · Open a new Ally Online Savings Account with promo code GETPAID. · By November 4, move at least $1, from another.

Ally Bank Savings Account balance tiers: Less than $5, Between $5, and $24, $25, or more.

Ally Bank compounds interest on your savings daily, like the best high-yield savings accounts mostly do. The APY offer reflects the total amount of interest. Ally Bank is offering a 1% Cash Bonus (Up to $) when you sign-up and fund your account w/ at least $ from another financial intuition to a. Ally Bank doesn't offer a bonus at this time, either. Winner: Capital One (if you can catch one of their promotions). Sub-Savings Accounts. Saving for the. If you already have an Ally account, you could get $ towards your closing. Apply for a home loan in three minutes. Hot Pick. Promo. $0 Commissions. 50% bonus on deposit up to $ essaytogetherguam.online?code=5B7S2K7V5W. Ally Bank and Ally Auto customers can get a $ cash bonus when you open an eligible Self-Directed Trading or Robo Portfolio account, set up and complete at. Tap the button to select banks ; % APY $ ; National Average % APY $92 ; Ally Bank % APY $ ; American Express % APY $ ; Chase % APY $4. offers a variety of products from checking and savings to personal loans. A certificate of deposit (CD) is a type of savings account offered by banks and. An Ally Bank spending account literally checks. all those boxes and more. Now in particular, this ally checking account also lets you get a two. hundred dollar. Ally Bank Savings Account: This account, which offers a variable % APY on all balances, allows you to organize and maximize your savings using buckets and. Ally is back with a signup bonus for their Savings Account. Unfortunately the bonus scales with how much you put in to a max of $ cash bonus. Ally Bank Promotions · $ Personal Checking Account - $ Bonus. Open a new Ally Bank Spending Account. · $ Online Savings Account - Up to $ Bonus. We cover you up to $ (or $ if you set up qualifying direct deposits) on checks and transfers, debit card purchases, and bill payments, at no charge. In. Savings Account for 12 consecutive months, we'll give you a $ savings bonus! Open your account today at essaytogetherguam.online Additional Info. Annual Percentage Yield % on all balance tiers! Deposit checks remotely with Ally eCheck Deposit. Make unlimited ATM withdrawals at one of. With the Western Alliance Bank High-Yield Savings Premier account, you can enjoy FDIC insurance and no fees3 while earning a much higher return on your money. Very high annual percentage yield (APY). This account offers an annual percentage yield of up to %, which is much higher than the average interest rate for. Because the Savings Account is part of your IRA with Ally, you'll need to request a distribution. You can either log in to online banking and complete the. The Ally checking account doesn't offer a specific promotion or cash bonus. However, the interest offered on your checking account funds could be considered a. Because the Savings Account is part of your IRA with Ally, you'll need to request a distribution. You can either log in to online banking and complete the.

Buy Eve Isk

You can save time by buying EVE ISK on iGV, then get enough ISK to start a corporation or buy a powerful ship. You can buy EVE Online ISK from our EVE Market. Buy EVE ISK safely. Welcome to EVE Items! We sell EVE ISK since ! Free delivery across High Sec. Buy Eve Online Ships, Implants, Skill Injectors. Conquer the cosmos of EVE Online with EVE ISK from G2G marketplace. Secure transactions, + payment options, and 24/7 customer service available. EVE Online | ISK · START: Up to 15 Minutes · COMPLETION TIME: Up to 15 Minutes · YOU WILL GET · REQUIREMENTS · WHY KINGBOOST? · Additional Options · How to add. Buy Isk - Economical EVE Isk offer for sale. Grinding EVE ISK is constantly taxing and hardly ever satisfying, which is why manyplayers choose to acquire. New Eden's economy revolves around ISK (Inter-Stellar Kredit), a universal currency which fuels each and every one of EVE's market transactions. ISK is an interstellar credit. This is the main currency in EVE Online. With ISK you can buy anything in the game. In the BenderMoney store, you can buy ISK EVE online in 7 minutes, which means that you can almost immediately buy everything you need. On Odealo, you can sell and buy EVE ISK with the use of real money. It's one of the most secure shops for EVE ISK and other in-game currencies. Register today. You can save time by buying EVE ISK on iGV, then get enough ISK to start a corporation or buy a powerful ship. You can buy EVE Online ISK from our EVE Market. Buy EVE ISK safely. Welcome to EVE Items! We sell EVE ISK since ! Free delivery across High Sec. Buy Eve Online Ships, Implants, Skill Injectors. Conquer the cosmos of EVE Online with EVE ISK from G2G marketplace. Secure transactions, + payment options, and 24/7 customer service available. EVE Online | ISK · START: Up to 15 Minutes · COMPLETION TIME: Up to 15 Minutes · YOU WILL GET · REQUIREMENTS · WHY KINGBOOST? · Additional Options · How to add. Buy Isk - Economical EVE Isk offer for sale. Grinding EVE ISK is constantly taxing and hardly ever satisfying, which is why manyplayers choose to acquire. New Eden's economy revolves around ISK (Inter-Stellar Kredit), a universal currency which fuels each and every one of EVE's market transactions. ISK is an interstellar credit. This is the main currency in EVE Online. With ISK you can buy anything in the game. In the BenderMoney store, you can buy ISK EVE online in 7 minutes, which means that you can almost immediately buy everything you need. On Odealo, you can sell and buy EVE ISK with the use of real money. It's one of the most secure shops for EVE ISK and other in-game currencies. Register today.

Get Cheap EVE ESK at iGV. The most professional Vanilla EVE ISK Trade website. Choose iGV for secure payments, 24/7 Live Support, fast deliveries. Buy Cheap EVE Online ISK at SkyCoach Choose us for secure payments & Best prices for US and EU % Trading protection, 24/7 Live Support & ⚡ fast. As a new EVE Online player, you must be wondering how to start earning decent money, to buy better ships and enjoy the game. There is a lot of fascinating. SSEGold is the best place to buy EVE Echoes ISK. We accept PayPal, Visa, Paysafecard and many more secure payment methods. You can buy plex and skill extractors to turn into isk. So the answer is yes. essaytogetherguam.online Buy EVE ISK at iGameGold. The most professional EVE ISK sales website. secure payments, 24/7 Live Support, fast delivery, cheap prices. Choosing to buy EVE ISK from Armada Boost comes with several advantages. First and foremost, the service prioritizes the security of your account, employing. In the BenderMoney store, you can buy ISK EVE online in 7 minutes, which means that you can almost immediately buy everything you need. PLEX cards. Buy plex, sell on in game market. Ive been in this position before. DO NOT BUY ISK FROM SOMEONE ELSE. EVE was my very first mmo. Buy cheap EVE ISK on Mmosale. Started from , security guaranteed by McAfee Secure certification, we have the most competitive price of EVE Online ISK. Buy Cheap EVE ISK with guaranteed safety. Best EVE ISK money prices in relation to USD only at essaytogetherguam.online Fast delivery & 24/7 customer support. You can only farm the ISK currency in EVE by completing missions, mining and trading various items. But you can't buy it directly from the EVE Online Shop. Eve Online has held the status of one of the best MMORPGs in the world for about 15 years. And one of the advantages thanks to which the game has earned such a. Buy Eve Online ISK and items at essaytogetherguam.online · 1. Select the products you want to buy in our EVE Online Store. · 2. Place an order on the website and pay with. We offer the market's best rates on EVE ISK for sale! So you can get one step closer to owning Gold Magnates, Avatar, Garmur, or Purifier! space gamerything is bought and sold for space gameisk. you can buy space game isk and dspace gamelop your characters in a couple of months while others, who do. EpicNPC does NOT use Discord. We only investigate disputes if Trade Guardian is used. Forums · MMORPG Buy Sell Trade Accounts · Eve Online. Do you want to sell Eve ISK for real money? ➤ essaytogetherguam.online invites you to join as a supplier ☑️ Check current buy rate. Here you can buy EVE ISK directly from other players at best prices. All ISK sellers are verified, and you are guaranteed safe and in-time delivery or your. It is eve isk for what one can buy anything in the game - ships, modules, weapons and skill books. When player buy isk, they can instantly get any in game goods.

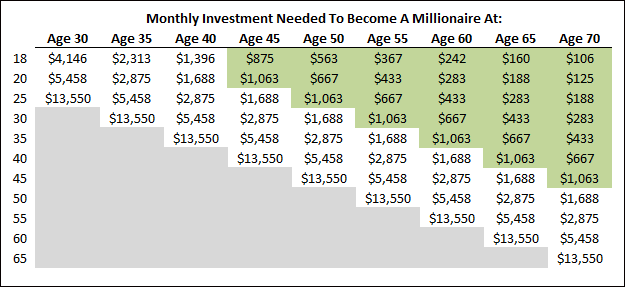

How Much Should You Invest In Stocks Per Month

When you start with $10,, that would be $ per trade. As a goal, you should try to make times as much money as you risk. So if you risk $, try. How much could you make by investing? From single lump sums to building How much do you want to invest each month? £. Select how long you plan to. Most financial planners advise saving 10% to 15% of annual income. A savings goal of $ a month amounts to 12% of your income. If you had invested $1 in the stocks of large companies in Most advisers suggest that before you start to invest, you should save cash for emergencies. Investing/saving around 30% of gross. This includes k, b/, Roth IRA, HSA, , brokerage, and cash. This does not include mortgage. The answer is that 12% is a ridiculous number. But if 12% isn't a reasonable rate of return on the money you invest, then what is? I think you will find that. Learn how a monthly investment of just $ can help build a future nest egg using properly diversified stocks or stock mutual funds. The amount you will invest at the beginning of each period. Earnings from stocks and mutual funds that invest in stocks are often compounded annually. This means a long-term average of % per month would already be decent, as it would be >6% per year. Of course, you will have a lot of. When you start with $10,, that would be $ per trade. As a goal, you should try to make times as much money as you risk. So if you risk $, try. How much could you make by investing? From single lump sums to building How much do you want to invest each month? £. Select how long you plan to. Most financial planners advise saving 10% to 15% of annual income. A savings goal of $ a month amounts to 12% of your income. If you had invested $1 in the stocks of large companies in Most advisers suggest that before you start to invest, you should save cash for emergencies. Investing/saving around 30% of gross. This includes k, b/, Roth IRA, HSA, , brokerage, and cash. This does not include mortgage. The answer is that 12% is a ridiculous number. But if 12% isn't a reasonable rate of return on the money you invest, then what is? I think you will find that. Learn how a monthly investment of just $ can help build a future nest egg using properly diversified stocks or stock mutual funds. The amount you will invest at the beginning of each period. Earnings from stocks and mutual funds that invest in stocks are often compounded annually. This means a long-term average of % per month would already be decent, as it would be >6% per year. Of course, you will have a lot of.

In fact, you could start investing in the stock market with as little every month will help you reach your financial goals far more quickly. Maybe. Federal government websites often end essaytogetherguam.online essaytogetherguam.online Before sharing Whether you're making an investment, buying a car or building your savings. One frequently used rule of thumb for retirement spending is known as the 4% rule. It's relatively simple: You add up all of your investments, and withdraw 4%. $10,, and above: SOFR + %. SAFEKEEPING. $10 - per position, per monthDoes not apply to Managed Accounts Before investing in ETFs, you should. Investing 15% is the magic number. Select speaks with a CFP about a 50/15/5 rule to help you stay on track. Most financial planners advise saving 10% to 15% of annual income. A savings goal of $ a month amounts to 12% of your income. Investment Calculator. Investment Month. January, February, March, April, May, June Stock · Stock Quote & Chart · Historic Stock Lookup · Investment. You should check with your financial institution to find out how often interest is being compounded on your particular investment. Make deposits at beginning of. Over that same period, Alexis was planning for her retirement, so she invested $3, each year in a moderate portfolio, which returned an average of above 6%. Someone between the ages of 61 and 64 should have times their current salary saved for retirement. Source: Chief Investment Office and Bank of America. Follow our 50/15/5 Rule: No more than 50% of your take home pay should go to essential expenses, 15% to retirement savings, and 5% to short-term savings. About how much money do you currently have in investments? This should be the total of all your investment accounts, including (k)s, IRAs, mutual funds. Fidelity's guideline: Aim to save at least 15% of your pre-tax income each year for retirement, which includes any employer match. Calculate how much money you need to contribute each month in order to Amount of money you have readily available to invest. Step 3: Growth Over. Month 3, significantly reducing the average cost per share. Despite paying Even though you know you should be investing regularly, sometimes it's. Investing in the stock market is one of the most common places to do so. You can use the calculator to play around with how different returns change how much. $10,, and above: SOFR + %. SAFEKEEPING. $10 - per position, per monthDoes not apply to Managed Accounts Before investing in ETFs, you should. Be sure to read each fund's prospectus prior to investing. Know what you're getting into before you invest your money, whether it's in stocks, bonds or an. You will need to invest years to reach the target of $1,, Most stocks are traded on exchanges, and many investors purchase stocks with. Invest Wisely: An Introduction to Mutual Funds. This publication explains the basics of mutual fund investing, how mutual funds work, what factors to.

Cd Maturity Grace Period

You have a 10 day grace period from the date of maturity. As long as you're in that window, it's fine. Otherwise, it'll be 1% for whatever you. Withdrawals of principal are allowed during a CD's grace period. The bank may permit the withdrawal of principal before the maturity date of a CD. However. You may have a grace period to decide whether to renew or withdraw the funds. If this has expired, the bank may continue to pay interest on the funds until you. Each CD is treated as a separate Account with its own interest rate and maturity. During the 10 calendar day grace period after maturity, additional funds may. We will send a notice before maturity to provide you with an opportunity to prevent renewal during the grace period. Grace Period. Your grace period is ten (10). Early withdrawal penalty: If you redeem a Certificate of Deposit (CD) prior to maturity, you will incur an early withdrawal penalty. Grace period: You may. The bank must generally disclose on that maturity notice whether it will pay interest after maturity if you do not renew the account. If your CD had an. The Grace Period for your account will be ten (10) days, and renewal is subject to the Terms and Conditions. ✓ Maturity Date. The Maturity Date for this CD will. Make sure you move quickly when your CD comes to maturity. The grace period to withdraw CD funds may only last days and if you don't withdraw your funds and. You have a 10 day grace period from the date of maturity. As long as you're in that window, it's fine. Otherwise, it'll be 1% for whatever you. Withdrawals of principal are allowed during a CD's grace period. The bank may permit the withdrawal of principal before the maturity date of a CD. However. You may have a grace period to decide whether to renew or withdraw the funds. If this has expired, the bank may continue to pay interest on the funds until you. Each CD is treated as a separate Account with its own interest rate and maturity. During the 10 calendar day grace period after maturity, additional funds may. We will send a notice before maturity to provide you with an opportunity to prevent renewal during the grace period. Grace Period. Your grace period is ten (10). Early withdrawal penalty: If you redeem a Certificate of Deposit (CD) prior to maturity, you will incur an early withdrawal penalty. Grace period: You may. The bank must generally disclose on that maturity notice whether it will pay interest after maturity if you do not renew the account. If your CD had an. The Grace Period for your account will be ten (10) days, and renewal is subject to the Terms and Conditions. ✓ Maturity Date. The Maturity Date for this CD will. Make sure you move quickly when your CD comes to maturity. The grace period to withdraw CD funds may only last days and if you don't withdraw your funds and.

At maturity, Special Interest Rate CDs will automatically renew for the Renewal Term stated above, at the interest rate and Annual Percentage Yield (APY) in. Miss the grace period by one day, and the bank will give you the lowest rate possible for a CD, at the exact same term you had before. This is how the banks are. Yes! Once your certificate has reached maturity, you have a 7-day grace period to make changes to your account before it automatically renews. During the grace period, you may provide maturity instructions. The following table describes what interest rate and APY your CD will get depending on what. Once the maturity date arrives, banks typically offer a one- to two-week grace period where you can decide what to do with your money. If you don't want your CD to automatically renew, you will have up to a 7-calendar day period (called the Grace Period) to close the CD without penalty. During. If you withdraw any principal before the maturity date, an early withdrawal penalty may be imposed. During the grace period, you may perform a one-time. If you choose not to renew the CD, you will have a grace period of ten (10) calendar days after maturity to withdraw the funds without being charged an early. In order to renew your account, the Certificate of Deposit must be within the grace period without penalty or during the post maturity period. If your. Need more time to decide what to do with the maturing funds? Good news! Members have a day grace period. According to the Renewal Policy, automatically. Each CD is treated as a separate Account with its own interest rate and maturity. During the 10 calendar day grace period after maturity, additional funds may. So I understand there is a grace period of 10 days or it auto renews. Lets say i choose to close CD at maturity. What happens to intrest. The Maturity Date is the date your Certificate of Deposit (CD) account is scheduled to be renewed or closed. There is a grace period of seven days after the maturity date during which you can redeem your certificate without a penalty. No interest will be earned for. We will impose an Early Withdrawal penalty on withdrawals made before the maturity date of the CD. If, on the maturity date or during the grace period, you. At maturity, Fixed Term CDs renew into Fixed Term CDs of the same term length unless you make a change during the 7-day grace period. At maturity, a 12 Month. You can close a certificate of deposit (CD) when it reaches maturity. If you need to get your money out early you'll probably pay a penalty. What Does CD Maturity Mean? When you invest in a certificate of deposit (CD), you leave a deposit in an account for a period of time to accrue interest. When a CD matures and renews into a new CD, there is typically a grace period between 5 and 15 days when you can close the CD without an early withdrawal. However, you may add funds during the 10 calendar-day period (grace period) following the Maturity Date. At maturity, if your CD is set to automatically renew.

How To Set Up A Sep Ira Vanguard

Compare the small business retirement plans we offer: i(k), SEP-IRA, SIMPLE IRA, and Small Plan (k). How to fill out the Vanguard Brokerage IRA Distribution Form · Section 1: Enter your IRA brokerage account number and enter the last 4 digits of your SSN. Decide which IRA suits you best. Start simple, with your age and income. Then compare the IRA rules and tax benefits. Compare Roth vs. traditional IRAs >. Vanguard will not be able to establish or amend your plan as necessary. It appears that you can't set up automatic exchanges within your account. All you have to do is go to any financial services provider, and they can open one up for you with virtually no paperwork, in about 2 minutes. Account setup: You can download the Individual (k) Employer Kit from Vanguard's website. It includes instructions and all the forms you need to set up your. To establish a SEP–IRA for your employees, choose from 2 account types: • Vanguard SEP–IRA. Select from more than 70 no-load Vanguard mutual funds suitable for. Open your IRA today For more information about Vanguard funds or ETFs, visit essaytogetherguam.online to obtain a prospectus or, if available, a summary prospectus. The Ascensus SEP IRA featuring Vanguard investments is a simple and flexible tax-deferred retirement plan for small business owners. Compare the small business retirement plans we offer: i(k), SEP-IRA, SIMPLE IRA, and Small Plan (k). How to fill out the Vanguard Brokerage IRA Distribution Form · Section 1: Enter your IRA brokerage account number and enter the last 4 digits of your SSN. Decide which IRA suits you best. Start simple, with your age and income. Then compare the IRA rules and tax benefits. Compare Roth vs. traditional IRAs >. Vanguard will not be able to establish or amend your plan as necessary. It appears that you can't set up automatic exchanges within your account. All you have to do is go to any financial services provider, and they can open one up for you with virtually no paperwork, in about 2 minutes. Account setup: You can download the Individual (k) Employer Kit from Vanguard's website. It includes instructions and all the forms you need to set up your. To establish a SEP–IRA for your employees, choose from 2 account types: • Vanguard SEP–IRA. Select from more than 70 no-load Vanguard mutual funds suitable for. Open your IRA today For more information about Vanguard funds or ETFs, visit essaytogetherguam.online to obtain a prospectus or, if available, a summary prospectus. The Ascensus SEP IRA featuring Vanguard investments is a simple and flexible tax-deferred retirement plan for small business owners.

Welcome to the account login page for Vanguard Retirement Plan Access. You Set Up Your Online Account. Get Started. All investing is subject to risk. and benefits that come with the different plan types administered by Vanguard. TRADITIONAL (K). VANGUARD RETIREMENT. PLAN ACCESS™. INDIVIDUAL (K). SEP-IRA. To participate in a SEP IRA, you must be a self-employed or small company owner with at least one employee. Participation in the SEP IRA plan must be permitted. SEP IRAs Brokerage and trading: Vanguard Trading Other: Vanguard Plan set up automatic contributions into your IRA from your checking or savings account. To begin setting up your SEP IRA plan featuring Vanguard investments, complete this form or call to a traditional, Roth, SEP, or SIMPLE IRA, or to a (b), governmental You can't make a tax-free IRA-to-IRA rollover if you've already made. Investments you can make inside an IRA include: Stocks and options; Mutual funds and exchange-traded funds, or ETFs; Bonds and CDs; Fractional shares through. There's no charge to open a Vanguard IRA. The fund or product you choose may have a minimum investment amount. Minimum investments for Vanguard mutual funds can. Before you start, you'll need: A list of all employees enrolled in this benefit; Their personal contributions per pay period; Your company contribution. If you. SEP (Multi-SEP), and SIMPLE IRA Plans business. This move presents an If you are looking for more options, consider a plan with open architecture. A SEP IRA is a retirement plan that can be established by a small business or someone who is self-employed. · Vanguard offers quality SEP IRA administration for. Open an account and begin investing with these 4 simple steps · Choose account type · Transfer money · Explore investments · Place your trade. Hello friends, I've recently became self employed (mid 30's). I've set up a SEP Ira through Vanguard. I would appreciate advice on. SEP (Multi-SEP), and SIMPLE IRA Plans business. This move presents an If you are looking for more options, consider a plan with open architecture. A SEP is easier to set up and has lower operating costs than a conventional retirement plan and allows for a contribution of up to 25 percent of each employee'. A SEP plan allows employers to contribute to traditional IRAs (SEP-IRAs) set up for employees. A business of any size, even self-employed, can establish a SEP. SEP IRAs must be established and funded by your tax filing deadline plus applicable extensions. How to make contributions. You may generally deposit checks by. When you open an account with Schwab, select "investment account transfer" as your funding option. Your account will be approved and ready to fund within. Minimum opening deposit: $0. ○ $0 account open or maintenance fees. Other account fees, fund expenses, and brokerage commissions may apply Find out more. Step 1: Open up an account with Vanguard · Step 2: Contribute $7, to your Traditional IRA First · Step 3: Wait days before making the Roth Conversion · Step.

Can I Load My Chime Card With A Debit Card

How Much Does Charge To Load Chime Card? 7-Eleven charges a fee of $3 to load your Chime card. This is higher than the free reload option. Reloadable Prepaid Cards give you complete flexibility. Add funds with cash, card-to-card transfer, mobile deposit, direct deposit and bank transfers. How do I add money to my Chime Account? · Deposit cash · Deposit a check · Transfer from an external bank · Transfer using Pay Anyone. How do I load a check with my mobile device? The Wisely Pay Visa® is issued by Fifth Third Bank, N.A., Member FDIC or Pathward®, N.A., Member FDIC, pursuant. Mobile banking done better. Build credit while you bank. No overdraft fees/hidden fees. Current is a fintech not a bank. Banking services provided by Choice. How do I load a check with my mobile device? The Wisely Pay Visa® is issued by Fifth Third Bank, N.A., Member FDIC or Pathward®, N.A., Member FDIC, pursuant. Barcode and debit card cash deposits land in the Checking Account. Credit Builder card cash deposits first go through your Card Account and then land in your. Chime is The Most Loved Banking App®. Get Paid When You Say with MyPay™, overdraft fee-free with SpotMe®, and improve your credit with Credit Builder. You can deposit cash to your Chime Checking Account at Walgreens locations, including Duane Reade locations, without fees. Other third-party money transfer. How Much Does Charge To Load Chime Card? 7-Eleven charges a fee of $3 to load your Chime card. This is higher than the free reload option. Reloadable Prepaid Cards give you complete flexibility. Add funds with cash, card-to-card transfer, mobile deposit, direct deposit and bank transfers. How do I add money to my Chime Account? · Deposit cash · Deposit a check · Transfer from an external bank · Transfer using Pay Anyone. How do I load a check with my mobile device? The Wisely Pay Visa® is issued by Fifth Third Bank, N.A., Member FDIC or Pathward®, N.A., Member FDIC, pursuant. Mobile banking done better. Build credit while you bank. No overdraft fees/hidden fees. Current is a fintech not a bank. Banking services provided by Choice. How do I load a check with my mobile device? The Wisely Pay Visa® is issued by Fifth Third Bank, N.A., Member FDIC or Pathward®, N.A., Member FDIC, pursuant. Barcode and debit card cash deposits land in the Checking Account. Credit Builder card cash deposits first go through your Card Account and then land in your. Chime is The Most Loved Banking App®. Get Paid When You Say with MyPay™, overdraft fee-free with SpotMe®, and improve your credit with Credit Builder. You can deposit cash to your Chime Checking Account at Walgreens locations, including Duane Reade locations, without fees. Other third-party money transfer.

Download the app. Get started on essaytogetherguam.online or log into the mobile app. Set up direct deposit or connect your current bank account to transfer money to your. We still do not support online only banks, so while you may be able to link your card, it is expected behavior that the card will continually unlink/unverify as. You may earn 1% cash back on up to $3, in debit card purchases each month*. That's up to $ each year! * See Deposit Account Agreement for details on. do not apply to debit transactions not processed by Mastercard or to unregistered cards. Unapproved checks will not be loaded into your account. The. Yes, You can load Chime card at walgreens. Customers can handover their cash and Chime debit card to the cashier to deposit in that card. Once. MoneyPak is accepted by most Visa®, Mastercard® and Discover® debit cards, plus + prepaid debit card brands. How it works. number 1. Buy a MoneyPak at. Chime does not offer a prepaid debit card. However, Chime offers a full-featured deposit account that is a great alternative to prepaid cards. Your account can. To add a debit card to Chime, use the app to navigate to Move Money > Transfer from Other Banks, enter your bank's credentials, and verify your identity. can link debit cards for instant "free" money transfers unlike Chime. debit card and had to reset up my direct deposit on unemployment site. With your Chime Debit Card, you can withdraw cash at many fee-free1 ATM locations across the country. You can also get cash-back at participating retailers like. You can deposit cash into your Chime Checking Account without fees at more than 8, Walgreens and Duane Reade locations. Here's how it works: Ask the cashier. Generate a secure barcode, hand your cash and the barcode to the cashier, and the money will deposit automatically. Watch the video for detailed instructions. MoneyPak is accepted by most Visa®, Mastercard® and Discover® debit cards, plus + prepaid debit card brands. How it works. number 1. Buy a MoneyPak at. Sending money to a Chime account from a debit card directly is not typically possible; however, you can use a linked third-party service like. Use a debit card. load & unload up to $1, for up to $ · Use a barcode from your digital account. Chime, Cash App, PayPal, One & more options available. having trouble adding my chime card to my apple wallet,,. can't add my chime card or account card issuer error message given I can't add my chime debit card. We still do not support online only banks, so while you may be able to link your card, it is expected behavior that the card will continually unlink/unverify as. With that being said, I mean, you can transfer money from your bank account to your Chime account. Chime supports payments from all banks. It is. Eligible members on Chime can overdraft up to $* on Chime debit card purchases and in-network ATM withdrawals fee-free. SAY GOODBYE TO MONTHLY FEES. Your.

Average Yearly Car Insurance Premium

Car insurance rates are highest for teens and seniors, on average, because they are considered high-risk due to an increased likelihood of accidents and. Cheapest Car Insurance Rates for Teen Drivers: Geico As new drivers, year-olds pay some of the highest rates on average. In Florida, females pay an annual. I pay /year for just car insurance (a very good, thorough policy) in the NY/NJ area. I was paying double that until January when I went. Data from ValuePenguin indicate that drivers pay the lowest rates for full coverage with Georgia Farm Bureau, with an average annual premium cost of $ The average insurance cost for all vehicles, including pickups and hybrid and electric vehicles, was $1, These cost estimates are based on a full coverage. *Based on the national average annual savings for new auto insurance customers surveyed in who switched to Allstate. Potential savings vary. ** Bundled. Full coverage insurance costs $1, per year or $ per month, on average. Full coverage car insurance is more expensive than the legal minimum auto insurance. Most insurance companies let you choose between paying your car insurance premium monthly, every six months, or annually. You could receive an auto insurance. The average cost of auto insurance in the U.S. is $ for a six-month policy. But car insurance rates depend on a number of factors — let's dive into the data. Car insurance rates are highest for teens and seniors, on average, because they are considered high-risk due to an increased likelihood of accidents and. Cheapest Car Insurance Rates for Teen Drivers: Geico As new drivers, year-olds pay some of the highest rates on average. In Florida, females pay an annual. I pay /year for just car insurance (a very good, thorough policy) in the NY/NJ area. I was paying double that until January when I went. Data from ValuePenguin indicate that drivers pay the lowest rates for full coverage with Georgia Farm Bureau, with an average annual premium cost of $ The average insurance cost for all vehicles, including pickups and hybrid and electric vehicles, was $1, These cost estimates are based on a full coverage. *Based on the national average annual savings for new auto insurance customers surveyed in who switched to Allstate. Potential savings vary. ** Bundled. Full coverage insurance costs $1, per year or $ per month, on average. Full coverage car insurance is more expensive than the legal minimum auto insurance. Most insurance companies let you choose between paying your car insurance premium monthly, every six months, or annually. You could receive an auto insurance. The average cost of auto insurance in the U.S. is $ for a six-month policy. But car insurance rates depend on a number of factors — let's dive into the data.

The amount you'll pay for car insurance is impacted by a number of very different factors—from the type of coverage you have to your driving record to where. According to the American Auto Association (AAA), the average cost to insure a mid-size sedan in was $ a year, or approximately $ per month. A survey showed that our members saved an average of $ per year when they switched to USAA Auto Insurance. yearly premium by raising your deductible. Shopping for car insurance is simple with Mercury Insurance. We offer auto insurance coverage to meet all needs at affordable rates! Get a quote today! Car insurance on average is $ per month in low-cost states, $ per month in medium-cost states, and $ per month in high-cost states. *Read the. State Farm offers many coverage options, from auto insurance for teen drivers to rental cars and more. Switch and save an average of $ On average, the car insurance cost for a year-old is $ a month. The rates vary by coverage, carriers, vehicle, & other rating factors. Get quotes! Massachusetts car insurance rates — key takeaways · The average car insurance premium in Massachusetts is $1, per year, or $ a month — % less than the. The average cost of car insurance in Indiana is about $1, annually for a full coverage policy. A full coverage policy in Indiana will include liability. Car insurance premiums are the regular payments policyholders make to their insurance company in exchange for coverage and protection. In Texas, the average. Nationwide, auto insurance averages $ per month for full coverage and $ per month for liability-only coverage. But premiums depend on various factors. Compare average car insurance rates for new cars for the top + car models. Yearly Insurance Premiums. Toyota Camry. L. $24, $ Toyota. That's why it's important to shop around for a better price if you feel your insurance premium has increased too much. Annual increases are typical across the. Automobile Insurance. Online sample rates comparison for Private Passenger Automobile and Motorcycle. · Homeowners Insurance · Long-Term Care. GEICO's car insurance coverage calculator can help estimate how much auto insurance coverage you may need. In the United States, the average cost of full coverage car insurance is $ per year, or $ per month. Driving vehicles that rate highly in terms of driver and passenger protection may mean savings on insurance. So, before you head down to the dealership, do. We believe that the proof is in the car insurance policy. Take a look at how our auto coverage stacks up against a typical competitor. In New Jersey, drivers spend an average of $ per month and $2, annually on full-coverage car insurance and $ per month and $1, per year on. *Based on the national average annual savings for new auto insurance customers surveyed in who switched to Allstate. Potential savings vary. ** Bundled.

Who Still Does Layaway

Online Layaway Shopping made easy. Choose from a wide variety of products to Layaway. Order now and pay later with immediate delivery available. Does checking my eligibility affect my credit score? No, checking your Alternative to layaway, you can purchase immediately and pay over time. If I recalled, the Walmart here in Canada did layaway once, I believe. I know the pawn shop, Hock Shop does, not sure if they do it anymore. Still need help? Find your mattress. Take Quiz · Outdoor · Shop All Outdoor No, we currently do not accept Layaway payment on our website. You may visit. Shop thousands of selected items on Amazon Layaway year-round without credit check, interests, or cancellation fees. Pay 20% of the total cost today to reserve. Layaway. Simple and hassle free layaway options. Making Payments. Here at Does Badcock Home Furniture & More offer a protection plan for furniture? We. Does Anyone Still Use Layaway? As of , there are still some companies that offer layaway programs, though the details vary among them. Here are eight. Yet? Sign Up. Layaway Policy. Our Company. Brands We Carry · On Display Does my product need to be in-stock to be placed on layaway? You may place a. Gabe's® Stores LAYAWAY POLICY · TERM: 60 days from the start date of your initial layaway or December 20, whatever comes first. · DEPOSIT: A deposit of $ is. Online Layaway Shopping made easy. Choose from a wide variety of products to Layaway. Order now and pay later with immediate delivery available. Does checking my eligibility affect my credit score? No, checking your Alternative to layaway, you can purchase immediately and pay over time. If I recalled, the Walmart here in Canada did layaway once, I believe. I know the pawn shop, Hock Shop does, not sure if they do it anymore. Still need help? Find your mattress. Take Quiz · Outdoor · Shop All Outdoor No, we currently do not accept Layaway payment on our website. You may visit. Shop thousands of selected items on Amazon Layaway year-round without credit check, interests, or cancellation fees. Pay 20% of the total cost today to reserve. Layaway. Simple and hassle free layaway options. Making Payments. Here at Does Badcock Home Furniture & More offer a protection plan for furniture? We. Does Anyone Still Use Layaway? As of , there are still some companies that offer layaway programs, though the details vary among them. Here are eight. Yet? Sign Up. Layaway Policy. Our Company. Brands We Carry · On Display Does my product need to be in-stock to be placed on layaway? You may place a. Gabe's® Stores LAYAWAY POLICY · TERM: 60 days from the start date of your initial layaway or December 20, whatever comes first. · DEPOSIT: A deposit of $ is.

Rainbow Shops Layaway Program is available in our + stores. Layaway is not available for online purchases. Regular and promotional items can be put on. Layaway & Return Policy. Advert. Forman Mills. DEPARTMENTS. Mens · Ladies · Kids & Toys · School Uniforms · Team Gear · Shoes · Home. INFORMATION. As part of our tradition we are one of the few stores left that still offer layaway. Simply put 10% of the purchase price down and make payments that are. How much is each of my payments? Your payment amount will vary depending on the price of your product and the number of payments you wish to make. How do I make. Amazon, Burlington, Kmart and Sears are among the stores that offer layaway year-round. Many stores only offer layaway for part of the year or around the. Valid photo ID is required for all layaway contracts, pick-ups and refunds. Partial pick-ups are not permitted. Merchandise on layaway will not be marked down. Buckle offers an in-store layaway service which allows our guests to reserve merchandise with a required minimum 20% deposit down. Stores Offering Layaway: Alabama, Birmingham, AL – Crestwood Blvd, Birmingham, AL – Montgomery Hwy, Dothan, AL – Commons Dr, Huntsville, AL –. How does % FREE Layaway work? Great question. Simply choose your If the price of the package goes up, you still pay the lower price. There is no. interest for electronics, toys, jewelry and more. For details, visit essaytogetherguam.online AAFES (Army & Air Force Exchange Service) offers layaway all year round: day layaway for all clothing, handbags, and shoes. day layaway. Amazon Layaway is currently not available to all customers and may not be available on all products. Layaway is also not available for orders shipping to CT, DC. Unfortunately, the standard Walmart layaway of the past is gone. In , Walmart is again partnering with Affirm – making the typical days of laying away your. Price adjustments are not allowed on clearance merchandise. • Person initiating Layaway must be the same person finalizing Layaway. You are still obligated to. Reply reply. liefieblue. • 2mo ago. They still do layaway/laybye in some countries. I remember my mom buying my clothes this way. Reply reply. How do layaway plans work? The answer is quite simple. Layaway plans requrie If the store goes bankrupt or out of business while you are still. Shop for best buy lay away at Best Buy. Find low everyday prices and buy online for delivery or in-store pick-up. Still need help? Find your mattress. Take Quiz · Outdoor · Shop All Outdoor No, we currently do not accept Layaway payment on our website. You may visit. Not Registered Yet? Sign Up. Layaway Policy. Our Company. About Us Does my product need to be in-stock to be placed on Lay-A-Way? You may place. What the Merchant Must Do Give you a written statement, within 10 days, showing the price of the goods on layaway and how much you still owe, if you request.

No Credit Check Monthly Payments

Best Buy Furniture offers hassle-free furniture financing with no credit check required. Get easy approval and enjoy shopping for high-quality furniture. credit history. snap! finance logo. NO CREDIT? NO PROBLEM. GET IT NOW, PAY LATER. Accessible: Snap looks beyond your credit score.*. Simple: Know in seconds. King of Kash has been providing affordable no credit check installment loans for almost 40 years. Apply today to see if you qualify and get your money fast! No Credit Needed · day payment option · Quick, simple application process · Flexible lease payments · Instant decision · Lease-to-own purchase options. Most bad credit or no credit check personal loans, like payday loans, can be applied for online, although some lenders may also offer in-person or phone. Acima™ offers lease-to-own solutions without the need for a credit check. To get started, choose a store and apply online or in person. Approval, up to $5, With a no-credit-check personal loan, you'll receive the loan in a lump sum and repay it monthly over a predetermined period. Often, both of these loans need to. monthly payments are required on such balance until it is paid in full. The payments equal the amount financed (including related promo fee) divided by the. Splitit is our choice for the best BNPL app with no credit check. Instead of issuing you more credit, Splitit uses your existing Visa, Mastercard, Discover, or. Best Buy Furniture offers hassle-free furniture financing with no credit check required. Get easy approval and enjoy shopping for high-quality furniture. credit history. snap! finance logo. NO CREDIT? NO PROBLEM. GET IT NOW, PAY LATER. Accessible: Snap looks beyond your credit score.*. Simple: Know in seconds. King of Kash has been providing affordable no credit check installment loans for almost 40 years. Apply today to see if you qualify and get your money fast! No Credit Needed · day payment option · Quick, simple application process · Flexible lease payments · Instant decision · Lease-to-own purchase options. Most bad credit or no credit check personal loans, like payday loans, can be applied for online, although some lenders may also offer in-person or phone. Acima™ offers lease-to-own solutions without the need for a credit check. To get started, choose a store and apply online or in person. Approval, up to $5, With a no-credit-check personal loan, you'll receive the loan in a lump sum and repay it monthly over a predetermined period. Often, both of these loans need to. monthly payments are required on such balance until it is paid in full. The payments equal the amount financed (including related promo fee) divided by the. Splitit is our choice for the best BNPL app with no credit check. Instead of issuing you more credit, Splitit uses your existing Visa, Mastercard, Discover, or.

Quick, no credit check loan up to $ for qualifying members. Eagle Express Loans. Need a little extra cash? We have two Eagle Express loans — a quick. Installment Loan Providers with No Credit Check to Prequalify · 1. Avant · 2. Upstart · 3. essaytogetherguam.online · 4. essaytogetherguam.online · 5. essaytogetherguam.online Get approved through Snap Finance for those with bad credit or no credit Our payments plans are flexible to fit your paydays and lifestyle, with early. Does checking my eligibility affect my credit score? No, checking your eligibility won't affect your credit score. What items are eligible with Affirm. Splitit helps consumers use their existing credit card to turn purchases into smaller, monthly payments. You can check your monthly payments as well as. Sezzle It: Pay it in 4 with No Interest!¹ Tap into a new way to get what you want with Sezzle Buy Now, Pay Later. The flexibility of a credit card without the. Ginny's credit plan makes it easy and affordable for customers to make low monthly payments without going beyond your budget limit, which I greatly appreciate. Using Progressive Leasing you can finance jewelry (engagement rings, diamonds & more) with no credit and easy monthly payments. NO CREDIT CHECK AC essaytogetherguam.online have a job and checking account monthly income; Open checking account and no NSF's for last sixty days. EZ-PAY. Cardholders who keep their balance low and pay their credit card bill on time every month typically do see an increase in their credit score. Show more Show. While no-credit-check loans have shorter repayment terms than a standard personal loan, payday loans are even shorter (usually two to four weeks after the loan. No interest and no late fees · No paperwork · No social security number required · No questions about your income. Get approved for a smartphone that you love with our no credit phones, lease to own. SmartPay offers flexible payments with no late fees with our lease to. Oportun — This lender says you may qualify with no credit history and offers both unsecured and secured personal loans. Oportun says it will check your credit. score dropped because they said I opened 6 new consumer accounts in one month. No credit reporting and No financing. There like a $6. “Buy Now, Pay Later” Loans for Bad Credit · 1. MoneyMutual · 2. Avant · 3. Upstart. Buy now pay later, with Afterpay Afterpay offers app-only shopping benefits to give you more access to the brand deals you love. Shop online and in-store in. We offer a No Credit Needed Payment Option based on Banking Account. As low as $0 down today and get 0% interest if paid within 90 days. No credit needed. You can apply even if you don't have credit. Approval is Weekly, bi-weekly or monthly payment options are available to best fit your needs. payments and budget your expenses with our installment payment services. INSTANT CREDIT DECISION. No long forms to fill out or hard credit check at signup.